DALLAS, TX -- March 11th, 2024 -- Aemetis, Inc. (Nasdaq:AMTX): Stonegate Capital Partners updates coverage on Aemetis, Inc. (Nasdaq:AMTX).

Company Summary

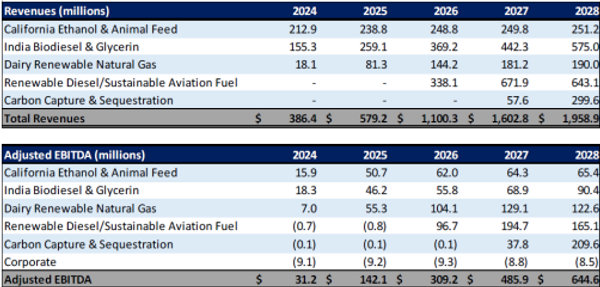

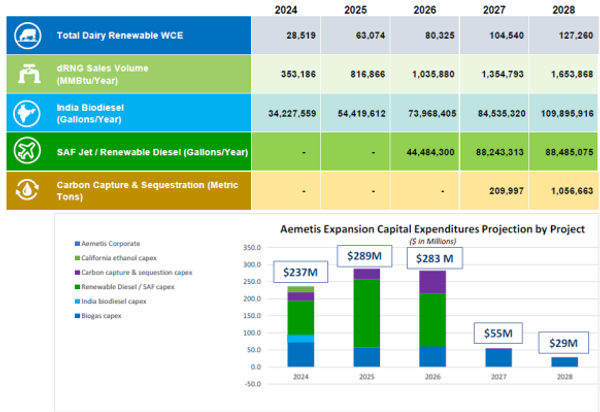

- 5-year Plan Shows Lots Of Growth: Aemetis outlined a 5-year plan to reach $2.0B in revenue and $644M in adjusted EBITDA by 2028 vs F23 revenue and adjusted EBITDA of $186.7M and $(22.4)M. respectively. While this is a long-term plan, AMTX has shown the ability to reach their benchmarks with the recent announcement of contract wins in India, continued completion of dairy biogas digesters, recent improvements made in the Keyes Ethanol Plant, being awarded the first CO2 sequestration characterization well permit issued by the state of California, and receiving its Air Permits for the 90M gallon per year sustainable aviation fuel plant.

- Dairy Biogas Pipeline: Aemetis expects to build new dairies biogas digesters over the next five years for a total of 66 dairies. Currently, AMTX has 9 completed digesters, with 9 more fully funded. We expect more digesters funded by the end of FY24. These digesters operate in conjunction with a 40-mile gas pipeline that AMTX built in 2023. In FY28, Aemetis is expecting revenue of $190.0M and adjusted EBITDA of $122.6M. AMTX is expected to have at least 18 completed plants by the end of 2024.

- Jet/diesel Plant: Aemetis announced in January 2021 that it is planning to build a 90M gallon renewable jet and diesel plant using below zero carbon intensity cellulosic hydrogen produced from waste almond orchard wood. The plant is expected to supply the aviation and truck markets with ultra-low carbon renewable fuels. In 1Q24 AMTX received the important Air Permit from the City of Riverbank to build its renewable diesel plant. Aemetis expects revenue of $643.1M and adjusted EBITDA of $165.1M by FY28.

- Aviation Fuel Offtake Agreements Signed: Aemetis announced the signing of binding supply agreements with 10 airlines worth $3.8B. These are 10-year, 250M gallon, agreements to supply sustainable aviation fuel to companies such as Delta Airlines, American Airlines, Quantas, and Japan Airlines. Additionally, Aemetis has signed a renewable diesel supply contract with a national travel stop company worth $3.2B.

- Ethanol Plant Upgrades Completed: AMTX currently operates a 65M gallon ethanol plant in Keyes, California that is also strategic to the Aemetis dairy biogas project. Aside from ethanol for the fuel market, the plant also produces animal feed, which is delivered to 80 dairies, creating synergies with potential biogas suppliers. Growth in the RNG segment is fueled by $23M of grants related to RNG, completion of the RNG interconnection unit with PG&E’s pipeline, and completing construction of the biogas-to-RNG upgrading facility.

- Biodiesel Shows Upside: AMTX operates a 60M gallon biodiesel plant in India. Importantly, the Indian government oil marketing companies are the primary purchaser of AMTX’s biodiesel. In 4Q23 the Company sold ~18.3M worth of metric tons, up from the 10.7M sold in 4Q22. We anticipate that capacity at this site will reach 100M gallons in FY25.

- Valuation – We are using a SOTP analysis. We are applying various EV/EBITDA multiples to Aemetis’ F28 projections and couple a discount range of 32.5% to 37.5% to discount the value to today with an annual shares outstanding growth rate range of 1% to 5%. As a result, we arrive at a valuation range of $17.28 to $25.26 with a midpoint of $20.86.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.