Ready to take your online store to the next level? Let’s dive into how e-commerce business loans can be the secret sauce to scaling your operations, boosting your marketing game, and keeping your inventory on point.

The E-Commerce Boom: Why Now’s the Time to Expand

First off, let’s talk numbers. The e-commerce scene is on fire! In 2023, global retail e-commerce sales hit a whopping $5.8 trillion, and projections suggest they’ll soar past $8 trillion by 2027.

With this explosive growth, there’s a golden opportunity for online sellers to ride the wave and expand their businesses.

But here’s the kicker: scaling isn’t just about having a killer product or a sleek website. It’s about having the moolah to back your ambitions. That’s where e-commerce business loans come into play.

Show Me the Money: What Are E-Commerce Business Loans?

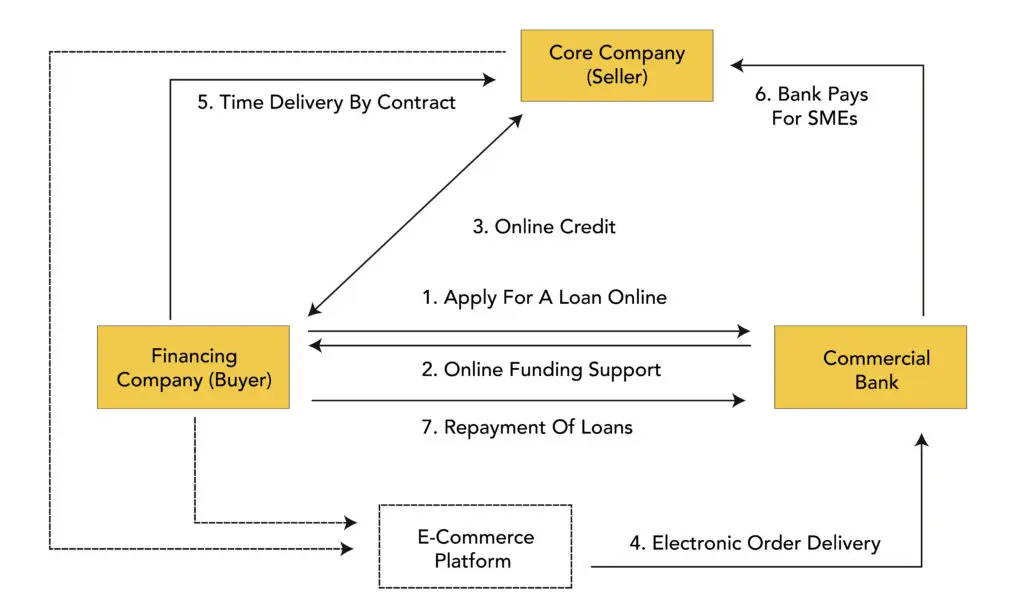

In simple terms, e-commerce business loans are financial lifelines designed to inject capital into your online venture. Whether you’re looking to stock up on inventory, launch a killer marketing campaign, or upgrade your tech, these loans provide the funds you need to make it happen.

Types of E-Commerce Business Loans

- Term Loans: Borrow a lump sum and pay it back over a set period with interest. Great for significant investments like warehouse expansions or major equipment purchases.

- Lines of Credit: Think of it as a financial safety net. Access funds up to a certain limit, and only pay interest on what you use. Perfect for managing cash flow hiccups or unexpected expenses.

- Merchant Cash Advances: Get a cash advance based on your future sales. Repay it with a percentage of your daily or weekly sales. Quick access to funds, but watch out for higher costs.

- Inventory Financing: Use your inventory as collateral to secure a loan. Ideal for businesses needing to stock up without draining cash reserves.

- Equipment Financing: Specifically for purchasing or leasing equipment. The equipment itself often serves as collateral.

Scaling Up: How Loans Propel Your Growth

Alright, so you’ve got the funds. Now what? Here’s how e-commerce business loans can turbocharge your growth:

1. Supercharge Your Marketing

In the crowded online marketplace, standing out is crucial. With extra capital, you can:

- Launch Targeted Ad Campaigns: Invest in Google Ads, Facebook promotions, or Instagram shoutouts to reach your ideal customers.

- Enhance SEO Efforts: Hire experts to optimize your site, making it more discoverable.

- Collaborate with Influencers: Partner with personalities who can showcase your products to a broader audience.

Remember, a killer product won’t sell if no one knows about it. Strategic marketing investments can drive traffic and boost sales.

2. Beef Up Your Inventory

Ever had to turn away customers because you ran out of stock? Bummer, right? With adequate financing, you can:

- Purchase in Bulk: Take advantage of supplier discounts and ensure you have enough stock to meet demand.

- Expand Product Lines: Introduce new items to attract different customer segments.

- Prepare for Seasonal Surges: Stock up ahead of peak shopping seasons to maximize profits.

Having the right products available when customers want them is key to building loyalty and driving repeat business.

3. Upgrade Your Tech Game

In e-commerce, a seamless user experience can make or break a sale. Use your loan to:

- Revamp Your Website: Ensure it’s mobile-friendly, fast, and easy to navigate.

- Integrate Advanced Analytics: Gain insights into customer behavior to tailor your offerings.

- Implement Efficient Inventory Management Systems: Keep track of stock levels in real-time to avoid overselling or stockouts.

Investing in technology not only enhances the customer experience but also streamlines operations, saving you time and money in the long run.

Navigating the Loan Landscape: Tips and Tricks

Securing the right loan requires some savvy moves. Here’s how to navigate the process:

1. Assess Your Needs

Before diving in, pinpoint what you need the funds for. A clear purpose will guide you to the right type of loan and lender.

2. Shop Around

Not all loans are created equal. Compare interest rates, repayment terms, and fees from various lenders to find the best fit for your business.

3. Check Eligibility Requirements

Some loans have strict criteria. Ensure you meet the minimum revenue, credit score, and operational history before applying.

4. Prepare Your Documents

Having your financial statements, business plan, and tax returns ready can speed up the application process.

5. Understand the Terms

Read the fine print. Be clear on repayment schedules, interest rates, and any penalties for early repayment.

6. Expanding to International Markets

E-commerce knows no borders. If you’ve nailed the local market, why not go global? With a business loan, you can:

- Set up localized versions of your website for different countries.

- Invest in international shipping and fulfillment centers to speed up deliveries.

- Navigate foreign tax regulations and customs by hiring experts.

- Run geo-targeted ads to introduce your brand to international audiences.

Global expansion means more revenue streams, but it also requires serious financial backing. A well-planned working capital business loan can make this dream a reality.

7. Hiring and Expanding Your Team

At some point, running your e-commerce empire solo (or with a small team) isn’t sustainable. Loans can help:

- Hire customer service reps to handle increased order volumes.

- Bring in digital marketing professionals to refine your brand strategy.

- Onboard logistics coordinators to streamline inventory and shipping.

- Employ IT specialists to optimize website speed and security.

Scaling a business isn’t just about increasing sales—it’s about making operations smoother so your growth is sustainable.

8. Launching Subscription Models for Recurring Revenue

Subscription-based models are becoming a goldmine for e-commerce brands. Why? Predictable income, customer loyalty, and long-term engagement. Business loans can help you:

- Develop and test a subscription box model for your niche.

- Secure bulk inventory upfront to ensure consistent supply.

- Implement recurring payment processing tools for seamless transactions.

- Offer competitive introductory pricing without straining your cash flow.

From beauty boxes to pet supplies, subscription services have skyrocketed in popularity. A short-term business loan can help you experiment with this model and drive steady revenue.

9. Integrating AI and Automation for Efficiency

AI-powered tools can revolutionize the way your e-commerce store operates. With extra funding, you can:

- Use AI chatbots to handle customer queries 24/7.

- Automate inventory management to avoid stockouts or overstocking.

- Implement AI-driven personalization, suggesting products based on customer behavior.

- Optimize pricing using AI that adjusts rates based on demand and competitor pricing.

Automation cuts down manual work, reduces errors, and improves customer experience—all of which lead to higher conversion rates and stronger sales.

10. Building a Brick-and-Mortar Presence

Many digital-first brands like Warby Parker and Allbirds have launched physical stores after finding success online. Loans can help you:

- Open a pop-up shop in key locations to test the waters.

- Lease warehouse space to serve as a local pickup hub.

- Set up small physical retail spaces for a hybrid shopping experience.

A small business loan program can make the transition from online-only to omnichannel seamless, giving your brand more visibility and credibility.

Real Talk: The Pros and Cons

Like all financial decisions, taking out a loan has its ups and downs.

Pros:

- Immediate Access to Capital: Fuel growth without waiting to accumulate profits.

- Maintain Ownership: Unlike seeking investors, loans don’t require you to give up a stake in your business.

- Build Business Credit: Timely repayments can boost your credit score, opening doors for future financing.

Cons:

- Debt Obligation: Loans need to be repaid, regardless of your business performance.

- Interest Costs: Borrowing isn’t free. Interest rates can add up, affecting your bottom line.

- Potential for Overleveraging: Taking on too much debt can strain your finances and limit future borrowing capacity.

Spotlight: Mercado Libre’s Success Story

Let’s take a page from MercadoLibre’s playbook. Often dubbed the “Amazon of Latin America,” they’ve mastered the art of integrating financial services to boost their e-commerce platform.

By offering instant loans to their sellers, MercadoLibre empowers businesses to scale rapidly. Sellers can access funds with a click, allowing them to invest in inventory, marketing, and technology. This seamless access to capital has led to a surge in sales and solidified MercadoLibre’s position as a market leader.

Wrapping It Up

Scaling your e-commerce business is an exciting journey filled with opportunities. With the right financing, you can amplify your marketing efforts, keep your inventory stocked, and enhance your tech infrastructure. But remember, while loans can provide the fuel for growth, it’s essential to borrow wisely and ensure that the return on investment aligns with your business goals.

Ready to take the plunge? Evaluate your needs, explore your options, and set your online store on the path to success. The digital marketplace is brimming with potential—it’s time to seize it!

Unlock Your E-Commerce Potential with VIP Capital Funding

At VIP Capital Funding, we specialize in providing online small business loans, working capital loans for small businesses, and equipment financing loans. With over a decade of experience, we empower small to mid-sized businesses across the United States, offering tailored financial solutions to stimulate growth and give your business a unique competitive advantage. Ready to elevate your online store? Apply for a small business loan today!

Quick & Simple Same-Day Funding — Up to $15MM

Quick & Simple Same-Day Funding — Up to $15MM