DALLAS, TX -- March 15th, 2024 -- International Personal Finance PLC (LSE: IPF): Stonegate Capital Partners updates their coverage on International Personal Finance PLC.

COMPANY UPDATES

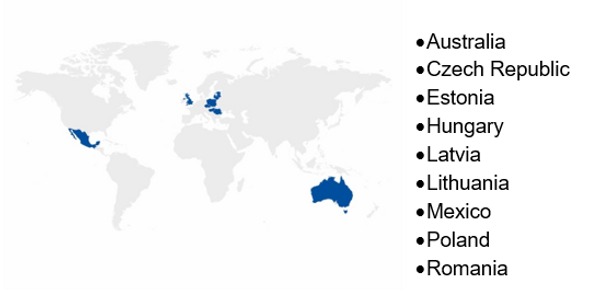

- Strong FY23: IPF reported strong net receivables up 12% year over year to £893M, excluding Poland. Additionally, customer lending was up 8% when excluding the transitional impact from operations in Poland. Annualized revenue yield was also strong, moving to 55.3% in 4Q23, up 340bps from 4Q22. Impairments remain in-line with expectations at 12.2%, in large part due to robust credit standards and despite the cost-of-living crisis. Lastly, the costs to income ratio is ahead of management plans, down to 57.0% in 4Q23. The Company remains on strong footing with the stated ambition to serve 2.5 million customers, a fraction of the 70 million underserved adults in the nine countries the Company serves. IPF is still seeing strong customer repayment performance in large part due to the responsible underwriting and operational rhythm despite the challenging macro environment.

- Continued Expansion in Mexico: IPF continued its expansion into the Mexico Home Market by following the opening of the Tijuana branch in 2022 with the opening of the Tampico branch in March of 2023. We expect IPF to expand into Mexicali during FY24. The learning curve to get these locations seems to be short as the Company reported an increase of 17.6% customer lending y/y, customer numbers growing by 2.9% in the quarter to 716,000 and closing receivables growing by 18.0% to £187.1M. This is all served by the very critical first cohort of employees.

- Credit Card is Building Traction: The roll out of credit cards in Poland is on track with 130,000 cards issued. This is up from 50,000 cards issued at 1H23, with the pace of uptake expected to maintain steady as the IPF continues to transition current customers. It is expected that the full transition of the Polish market will be completed by the end of 2024 with further regulatory guidance received from KNF.

- Digital Strength Remains: Digital saw positive momentum in all markets as profit before tax increased 21.6% and customer leading growth increased 9% when excluding the impacts from the transition in Poland. Of note was the increase in gross receivables to £287.9M, which is up 11.6% year over year.

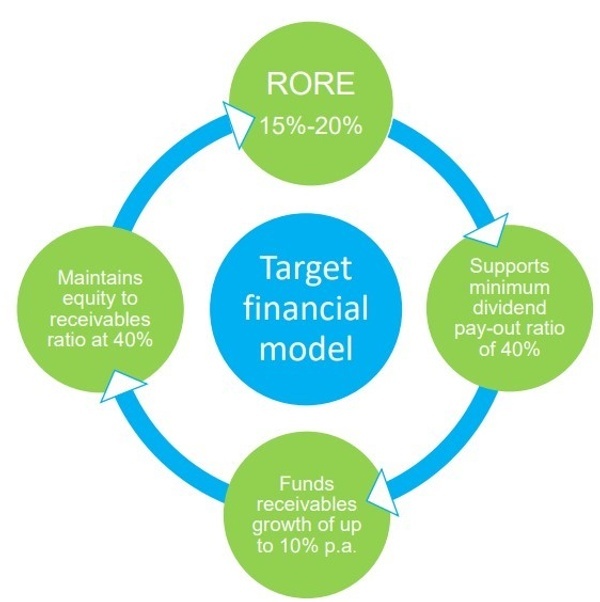

- Funding: IPF ended the year with working capital of £549.2M and a cash balance of £42.5M, which is up from £28.2M at the end of 1H23. The Company’s receivables ratio was 56%, up from 51% at the end of FY22. We note that headroom on borrowing facilities was at £126.0M. Notably the Company extended £146.0M of debt facilities in 2023 with duration now standing at 2.0 years with £170.0M of debt now maturing beyond 2025.

- Valuation: We use a DCF Analysis and a Comparison Analysis to frame valuation. For the comparison analysis we used a combination of P/E, P/TBV, and EV/EBT multiples to determine a valuation range for IPF. When we blend these multiple comparisons, in combination with our DCF analysis, we arrive at a median price range of £1.85 to £2.20 with a midpoint of £2.01.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.