DALLAS, TX -- March 12th, 2024 -- NCS Multistage Holdings, Inc. (NASDAQ: NCSM): Stonegate Capital Partners updates their coverage on NCS Multistage Holdings, Inc. (NASDAQ: NCSM).

COMPANY UPDATES

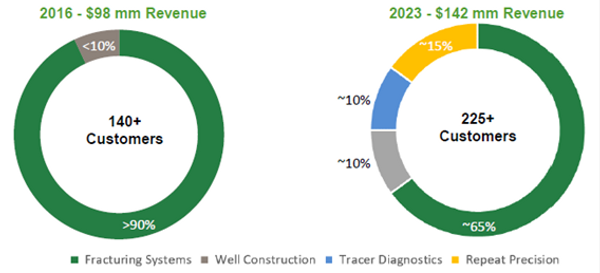

- Growth Potential: NCSM is involved with approximately 30% of Canadian well completions and is the second largest plug and perf provider by market share in Canada. While there is less market share to capture in the US, we expect Repeat Precision to give NCSM diversification among completion methods and bolster its US based operations. The Company is also capturing market share both overseas and on deep water rigs, with the North Sea customer base expected to expand further in FY24. We note that NCSM generated 29% of revenues in FY23 from its services segment, making the Company well diversified across operations and geographies.

- Quarterly Results: NCSM reported revenue, adj EBITDA, and EPS of $35.2M, $2.5M, and $15.96, respectively. This compares to our estimates of $41.5M, $5.9M, and $1.45, respectively. EPS results were largely due to the ~40.8M worth of litigation provisions. After adjusting for the litigation provision, the Company still posted solid Adj. EBITDA results of $11.9M for the full year 2023. We expect NCSM to maintain reasonably strong margins due to cost optimization through FY24.

- Robust Balance Sheet and Liquidity Position: NCMS ended 4Q23 with net working capital of $56.3M, which is flat from $55.2M in 4Q22. The Company also closed the quarter with $16.7M in cash and $16.4M of undrawn revolver for liquidity position of $33.1M. This compares favorably to only $8.2M in debt and FY23 capex of $1.7M.

- Litigation Updates: NCSM has made progress among two outstanding legal challenges. In the first, NCSM received a judgement that was settled as expected with the Company receiving unpaid invoices and the plaintiff received funds from NCSM’s insurance policy. This resulted in the above-mentioned litigation provision line item on the Income Statement, without any cash payments from NCSM. In the other, NCSM has stated that the two parties are still in negotiations, with both parties attending a mediation meeting in late February of 2024.

- Cash Flows: For the year, NCSM delivered $2.6M of FCF after distributions to non-controlling interests. This is compared to a negative FCF balance of $2.1M in FY22. CapEx for FY24 is guided at $2.0M to $3.0M. It is expected that NCSM will be FCF positive in FY24.

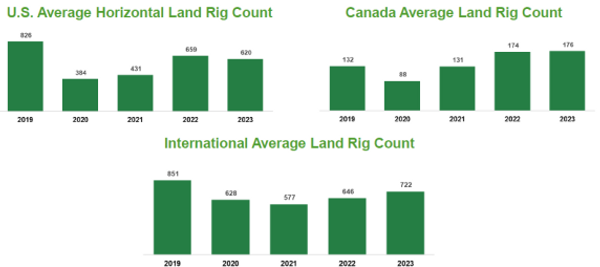

- Updated Guidance: Currently, the Canadian market is expected to be flat y/y and the United Stats market is expected to decline 5% to 10% y/y, with Repeat Precision expected to help buoy this decline. It is expected that the international market will improve by 5% to 10% y/y. The Company is guiding to a revenue range of $145.0M to $160.0M. This is coupled with a $13.0M to $17.0M adjusted EBITDA guidance. We have made modest adjustments to our model.

- Valuation: We use both a DCF and EV/EBITDA comp analysis to guide our valuation. Our DCF analysis produces a valuation range of $21.93 to $28.10 with a mid-point of $24.61. Our EV/EBITDA valuation results in a range of $21.68 to $28.03 with a mid-point of $24.86.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.