DALLAS, TX -- August 8th, 2023 -- HIVE Digital Technologies LTD. (TSXV: HIVE): Stonegate Capital Partners updates coverage on HIVE Digital Technologies LTD. (TSXV: HIVE) The full report can be accessed by clicking on the following link: HIVE Q1 2023 Report

Company Updates

- Name Change as Industry Evolves: HIVE recently announced that it will change its name from “HIVE Blockchain Technologies” to “HIVE Digital Technologies”. This adjustment is to more fully capture the potential that HIVE sees in the market to not only take advantage of the possibilities provided by mining bitcoin, but also to use their GPU units to drive stable revenues in the High Performing Computers segment, specifically around AI applications.

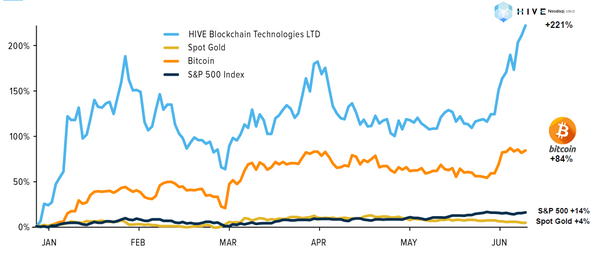

- Leader in Bitcoin Mining: HIVE is the first publicly traded cryptocurrency miner and was listed in 2017 on the TSX Venture Exchange. We estimate the Company is generating over 9.8 Bitcoin per day, which translates to $274,400 revenue in crypto every day using May month spot prices. This is up from $194,628 in January of 2023. Due to recent price volatility for forward run rate calculations, we will use the trailing 30-day average of $28,775 BTC price for our revenue assumptions. This is amplified by the high operating efficiency that the Company has of approximately 92.4 BTC mined per EH as of May 2023. This is among most efficient BTC/EH in the industry.

- More Tasks Given to Repurposed GPUs: Historically, HIVE generated significant revenues and profits from mining Ethereum (ETH). On 9/15/22, ETH “merged” with Beacon Chain making ETH mining obsolete. Due to the “merge”, HIVE repurposed their GPU fleet to mine altcoins (cryptos outside of BTC) and has maintained profitability mining these coins. HIVE has also announced that in 2Q23 these GPUs will be used for cloud computing services supporting AI, a venture that can be 25 times more profitable than using the GPUs for mining. With how GPU intensive AI applications are, this GPU allocation gives investors direct exposure to AI.

- ESG Oriented: The Company has a green energy focus that includes hydroelectric and geothermal energy that powers their mining facilities. The Company owns green energy-powered data center facilities in Canada, Sweden, and Iceland which produces minted digital currencies. Notably, the recent infrastructure upgrades in New Brunswick and Quebec were completed using green, clean, and cheap energy.

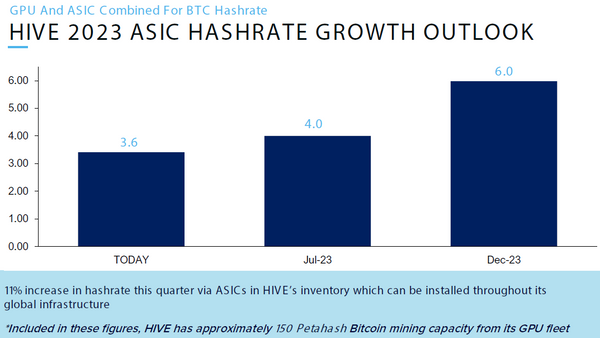

- Positioned to Benefit from Price Correction: The Company mines and holds Bitcoin, leading to large revenue swings. There are many secular drivers which support upward bias to spot prices, including a limited supply curve, increased institutional interest, and steady progress in regulatory acceptance for Bitcoin. HIVE is strategically positioned to take advantage of its recent ASIC purchases at attractive prices as well as its increasing store of Uncommon Sats. We believe a near term catalyst could be if the Fed pivots to a more dovish stance and/or the BlackRock and Fidelity ETFs gaining approval from the SEC.

- Valuation: We are valuing the Company based on our 2024 estimates:

- EV/EBITDA: Applying an EV/EBITDA range of 10x to 11x, with a midpoint of 10.5x, results in a price range of $4.10 to $5.10, with a midpoint of $4.85.

- EV/Revenues: Applying an EV/Revenue range of 3x to 4x, with a midpoint of 3.5x, results in a price range of $4.51 to $6.14, with a midpoint of $5.33.

- EV/Exahash: Applying an EV/EH range of 150x to 200x, with a midpoint of 175x results in a price range of $5.58 to $7.57, with a midpoint of $6.58.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.