Information

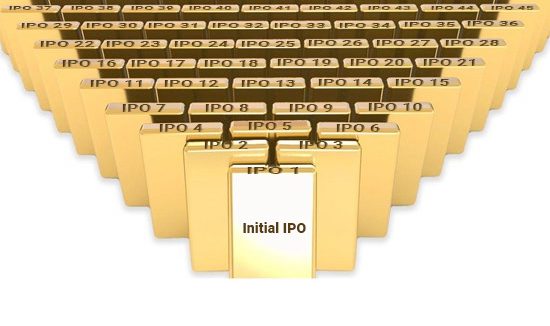

IPO Cascade

The IPO Cascade is a patented process conceived by Marc Deschenaux and licensed exclusively to Swiss Financiers Inc. Swiss Financiers Inc, or SFI, is a Delaware registered company with a

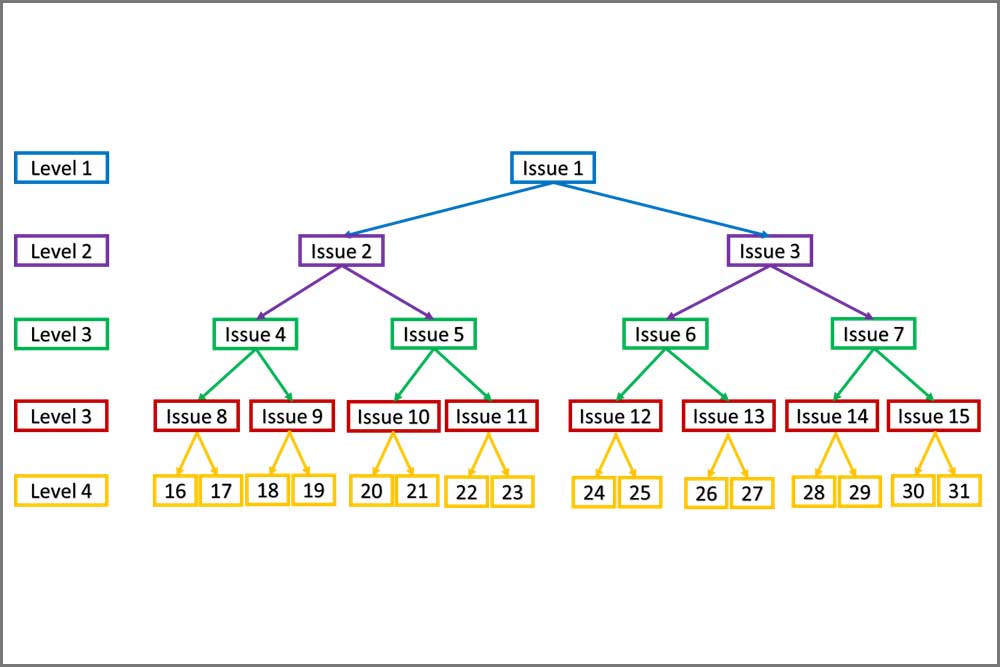

Cascade Direct

This presentation focuses on a unique structure designed to assist and support private companies achieve public listing, while simultaneously creating a forward looking partnership with

Cascade Incubator

This presentation focuses on a unique structure designed to assist and support private companies achieve public listing, while simultaneously creating a forward looking partnership with

Cascade Program

The Cascade IPO structure was created by Marc Deschenaux, co-founder of Swiss Financiers, and is a Patented Business Process offered only by Swiss Financiers. It