DALLAS, TX -- August 7th, 2023 -- Independence Contract Drilling, Inc (NYSE: ICD): Stonegate Capital Partners updates coverage on Independence Contract Drilling, Inc. The full report can be accessed by clicking on the following link: ICD Q2 2023 Report

COMPANY UPDATES

ICD continued momentum in 2Q23 despite the softness seen in the market overall. The Company saw year-over-year revenue and EBITDA increases of 33% and 102%, respectively. Management noted that the Permian Basin market remains strong and is expected to strengthen. While the Company paused rig reactivation to begin 2Q23, this gave ICD the opportunity to redeem $5.0m of the convertible notes outstanding at par. Lastly, ICD has another rig conversion in process, with more planned in the back half 2023.

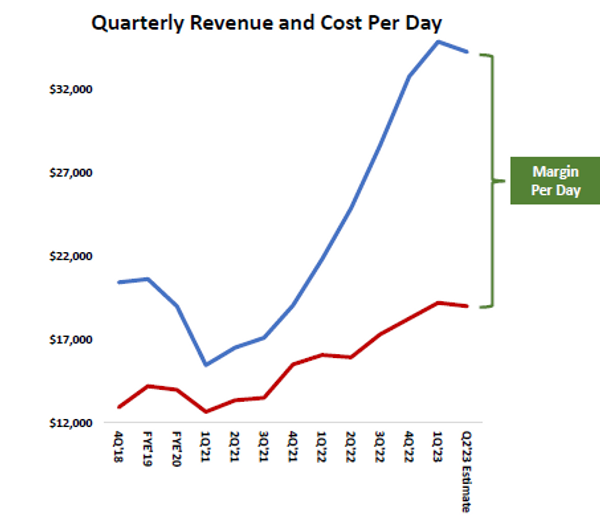

- Operating Days and Margin: ICD exited 2Q23 with 21 activated rigs and an average rig count of 15.0. With dayrates averaging $34,467 and margins of $15,462. The Company saw revenue growth of 33.2% year-over-year and Adjusted EBITDA growth of 102.2% year-over-year. ICD ended 2Q23 with a backlog of $42.2M.

- 2Q23 Results: ICD reported revenue, adj EBITDA, and adj EPS of $56.4M, $18.7M, and ($0.30), respectively. This compares to our/consensus estimates of $59.6M/$57.6M, $18.7M/$16.0M, and ($0.26)/($0.24), respectively. Both revenue and gross profit were lower than expectations due to lower dayrates. Operating expenses were lower than expectations, leading OPM higher. Due to the stronger margins, Adj. EBTIDA was in-line with our model.

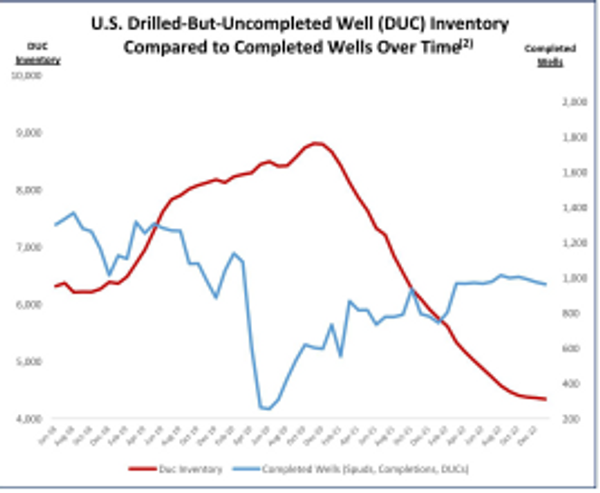

- Headwinds in Haynesville Market: The Company, along with the rest of the industry, is seeing softness in natural gas prices. This is reducing drilling activity in the Haynesville market, where the company operates. To navigate this challenge ICD has moved six of its ten rigs out of the Haynesville market. This operation was complete as of 2Q23. Of the remaining 4 rigs it is notable that 3 are revenue generating, and management believes that the fourth could be put to work soon. We are encouraged by how efficiently the Company completed the transition. This gives us confidence that ICD will be able to return rigs to that market should natural gas prices improve.

- Debt Goals in Focus: Given the pause in rig reactivation, the Company took the opportunity to redeem $5.0m of the convertible notes outstanding at par. ICD also ended the quarter with liquidity of $19.1m between the $5.6m cash balance and $13.5m revolver availability. Management continues to prioritize de-leveraging as a strategic priority, and we expect this to materialize as more offers to redeem convertible notes over the coming quarters.

- Valuation – We use both an EV/EBITDA and EV/Rig comparison for our valuation of ICD.

- ICD is trading at a FY24 EV/EBITDA of 2.2x compared to comps at an average of 5.0x. We are using a range of 2.3x to 3.0x. This arrives at a valuation range of $2.88 to $7.62 with a mid-point of $5.25.

- ICD is also trading at a discount relative to peers when comparing the EV/Rig multiples. ICD currently has 26 marketable rigs and is trading at 7.5x EV/Rig multiple vs median comps at 11.7x. We believe the Company should be trading in a range of 8.0x to 10.0x with a midpoint of 9.0x. This arrives at a valuation range of $3.67 to $7.42 with a mid-point of $5.54.