DALLAS, TX -- May 9th, 2024 -- OppFi, Inc. (NYSE: OPFI). Stonegate Capital Partners updates their coverage on OppFi, Inc. (NYSE: OPFI).

Company Update

- Financial Results: OPFI reported revenue, adj. EBITDA, and adj. Net Income of $127.3M, $31.5M, and $8.8M, respectively. This compares to our/consensus estimates of $124.0M/$135.4M, $21.4M/$24.9M, and $4.7M/$6.4M. Net revenue margin was 49.6% for the quarter, which was a year over year margin expansion of 213bps from 1Q23. These strong results are driven by both an expansion of revenues as well as moderation of the Company’s expenses. We anticipate that this trend will continue through the balance of 2024 as OPFI focuses on profitability.

- Originations: Total net originations for the quarter were $163.5M, which is down from the $191.9M posted last quarter and up from $159.6M in 1Q23. We note that originations tend to follow seasonal trends. We expect originations to continue to improve year over year as the Company expands its geographic footprint, further growing the total addressable market. Of the originations in the quarter 100% were by Bank Partners, up from 95% in 1Q23 and flat from 4Q24 as the Company has exited direct lending. Auto approval rate for the quarter was 73%, which was flat from last quarter and up from 70% in 1Q23. This resulted in ending receivables of $371.4M, up from $369.7M in 1Q23. We note that management has reiterated that OPFI will not chase growth at the expense of quality.

- Lending Standards: Charge-offs as a percentage of total revenue stood at 48% to end the quarter, which is down from 49% at the end of 1Q23. We view this as proof of the Company’s ability to simultaneously grow revenues and manage credit quality. Yield was 130%, an expansion from 126% a year ago. We expect OPFI to continue focusing on the lowest risk segment as upmarket banks tighten credit standards, further strengthening OPFI’s credit position with selective growth opportunities.

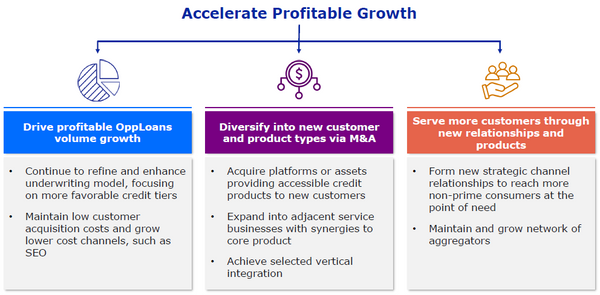

- Liquidity and Balance Sheet: OPFI ended the quarter with $88.7M of cash and restricted cash, an increase of $14.8M from 4Q23. The Company also had $224.7M of unused debt capacity, which when combined with $47.2M of unrestricted cash totaled $271.9M in liquidity. We are encouraged by the optionality afforded by this strong liquidity position and believe that the Company could use the funds to return value via additional dividends, share repurchases, external growth, and/or funding organic growth initiatives. OPFI has already paid a special dividend utilizing $12.7M of cash in 1Q24.

- Guidance: OPFI has reiterated its full-year revenue guidance and raised both the adj. net income and adj. EPS guidance for FY24. Revenue guidance is maintained at a range of $510.0M to $530.0M, which implies y/y revenue growth of 2.2% at the midpoint. Adj. NI guidance was raised to a range of $50.0M to $54.0M, which implies y/y growth of 21.6% at the midpoint, up from a range of $46.0M to $49.0M. Adj. EPS guidance was raised to a range of $0.58 to $0.62, which implies y/y growth of 19.3% at the midpoint, up from a range of $0.53 to $0.57. We believe the Company is positioned to meet and exceed its guidance. We have adjusted our model accordingly.

- Valuation: We use a P/E comp analysis to guide our valuation. Our valuation relies on a P/E multiple range of 7.0x to 9.0x with a midpoint of 8.0x This arrives at a valuation range of $4.69 to $6.03 with a mid-point of $5.36.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.