Dallas, Texas--(Newsfile Corp. – May 4, 2023) - Alliance Resource Partners, L.P. (NASDAQ: ARLP): Stonegate Capital Partners updates coverage on Alliance Resource Partners, L.P. To download the report, view the full announcement, including downloadable images, bios, and more click here: ARLP Q1 2023 Report

ARLP Releases Strong Earnings to Start 2023

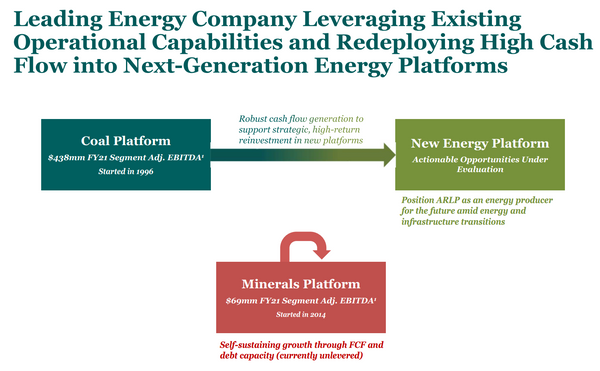

ARLP reported solid 1Q23 results that continued the trend of strong growth. Both volume and pricing came in better than 1Q22. While inflationary pressures impacted both labor and transportation expenses, top line performance more than offset the effect. In the short-term the Company expects challenges from domestic demand as well as labor inflation, with the potential for an improved outlook in 2H23. Given this, ARLP updated their 2023 guidance to slightly decrease expected coal ASP. We have updated our model slightly; however, we note that management is still optimistic that the full year 2023 results will be the strongest in company history.

- Strong 1Q23 results – ARLP reported revenue, adjusted EBITDA, and adjusted EPS of $662.9M, $270.9M, and $1.45, respectively. This compared to our/consensus estimates of $686.3M/$667.2M, $255.5M/$250.2M and $1.26/$1.25, respectively. Upside was seen at all segments, but coal sales were the main driver of the strong year over year revenue growth. This revenue growth outpaced EBITDA expenses per ton helping the company grow EBITDA 75.2% year over year.

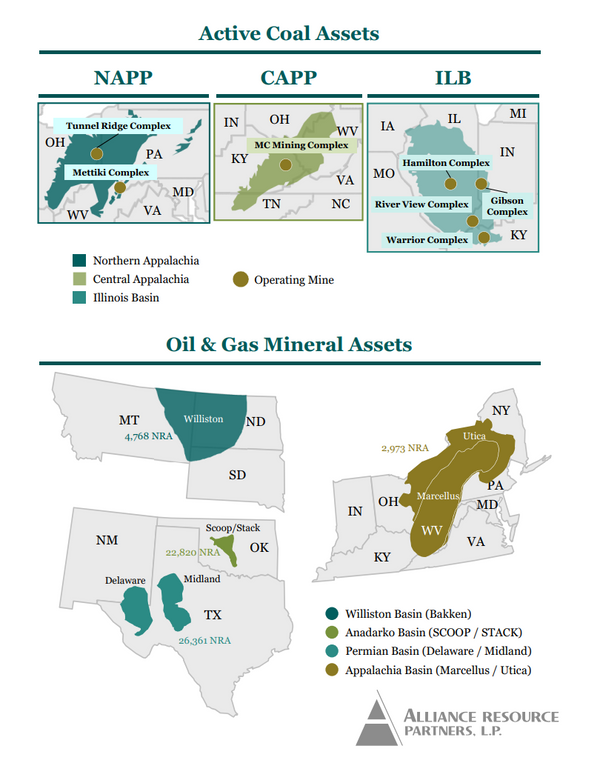

- Coal operations continue to point positively – ARLP 1Q23 coal sales were $578.8, up 49% y/y and down 8.3% q/q. Volumes sold also increased 3.8% y/y to 8.5M tons. Pricing (asp/ton) was also up 43.6% y/y to arrive at $68.34 compared to $47.58 in 1Q22. While inflation issues continue to negatively impact operations and supply/demand dynamics remain a challenge in the short term ARLP can be expected to grow revenue due to the increased expected ASP in combination with the 93% of order book that is already committed and priced.

- Royalty business also has tailwinds – O&G royalties saw solid results with revenue growing 11.5% y/y to $34.5M. Volumes were up 39.5% y/y, prices were down 26.0% y/y. The royalty business is expected to continue to benefit from the favorable energy market conditions, favorable forward pricing, and increased drilling/completion activity.

- Strong liquidity and cash flow position – The Company ended 1Q23 with a liquidity position of $703.6M, of which $271.3M is in cash. This strong liquidity position allowed ARLP to repurchase $26.6M worth of its $400M senior note outstanding that is due May 1, 2025. Management is expected to prioritize debt repurchases over the coming quarters. Additionally, the Company repurchased and retired $18.2M worth of units in the quarter. This is in concert with the $0.70 distribution per unit in the quarter, an increase of 100% year over year. ARLP also generated $139.9M of free cash flow in the quarter, a significant increase from $45.0M generated in 1Q22.

- Valuation – We use a comparative analysis to frame valuation. Given the strong guidance given by management, we are comfortable forecasting into and using FY24 adjusted EBITDA estimate. Using an EV/EBITDA range of 3.0x to 3.5x with a midpoint of 3.25x, we arrive at a valuation range of $25.36 to $29.81 with a mid-point of $27.59.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of public companies. Since their inception, their mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.