INDEPENDENT INVESTMENT REPORT

EXECUTIVE SUMMARY

Venu Holding Corporation is redefining how live entertainment is experienced in targeted U.S. markets. The company has created a compelling business model, which is centered around a vertically integrated entertainment campus, combining live-events, with upscale dining in state-of-the-art venues. After achieving proof of concept, management is now following a decisive expansion strategy, coupled with innovative financing methods to ensure growth with limited balance sheet expansion. Based on our baseline scenario, revenues are expected to grow from USD 17.8M in 2024 to over USD 600M by 2029 and are supported by a robust pipeline and improving utilization rates. While early-stage losses are typical, EBITDA is forecasted to turn positive by 2026 and net profitability follows in 2027. Given the company’s differentiated value proposition, expanding and improving fundamentals, we set our 2026 year-end stock price target tat USD 22.3, implying a significant upside from current levels.

INVESTMENT MERITS

- Strategic focus on filling a void in primary markets enables high growth with little direct competition

- Capital-efficient expansion model leverages municipal support and fractional suite pre-sales

- Broad and recurring revenue streams from events, hospitality, sponsorships, and naming rights

- Strong forward guidance with projected revenue growth from USD 17.8M to over USD 600M by 2029

- Proven leadership team and strategic partnerships, including AEG Presents, provide credibility

- Aramark agreement improves fan experience and decreases executive risk (includes a USD 10.25 million investment in VENU at what was effectively a 50% premium to market price)

INVESTMENT CONCERNS

- Profit-sharing agreements and potential opening delays may pressure margins longer than expected

- Execution risk is possible, as multiple new venues are launched in parallel across the nation

- Preferred equity structure adds fixed dividend obligations and potential dilution upon conversion

- Heavy reliance on municipal cooperation could limit flexibility

- Limited operating history and lack of full year venue utilization figures create forecasting uncertainty

- Growth assumptions depend on sustained consumer discretionary spending, which may weaken in a recessionary environment and impact all revenue streams (cyclical business model)

CATALYSTS TO WATCH

Key catalysts assume on-time completion and initial performance of venues currently under development, particularly in McKinney, El Paso, and Broken Arrow. Quarterly earnings releases and investor calls should be monitored closely to assess construction progress and pre-sale traction volume as gauge of interest. As the investment case relies heavily on forward-looking estimates, even minor shifts in project timelines or ramp-up assumptions can have a meaningful impact on valuation and thus should be reflected in a timely reassessment.

INTRODUCTION

What are your first thoughts when your favorite musician comes to town? Do you feel enthusiastic about going to a live event again? If you are younger than 20 or 30, chances are you are more willing to put up with the crowds and chaos. However, most people tend to think differently. Sure, you would love the experience but cannot stop thinking about the congested parking lots and overwhelming lines. Not even to mention bad seating or overpriced, yet disappointing, food offerings.

Now, what if we told you that a company is actively changing the way that we experience live music events altogether. They are reimagining the entertainment industry by constructing and operating music venues, which lay the focus on the total customer experience. Their motto is to make every show an unforgettable experience for both attendees and performers. The latter want their fans to have the best possible experience, too, especially now that live performances have become their primary source of income. Therefore, artists start laying their focus on modern amphitheaters and concert halls, as they are specifically built for year-round live music and related events – unlike stadiums and arenas. Hence, your negative thoughts about attending a live-event could be an element of the past – if, and only if, you chose the right venue.

OVERVIEW

Venu Holding Corporation (Venu Holdings or Venu for short) is on a mission to redefine live-entertainment in the United States and is headquartered in Colorado Springs. The company was founded in 2017 by its CEO, JW Roth, a successful entrepreneur with more than three decades of experience. Since its inception, Venu has advanced from being a single restaurant into a multi-venue owner-operator and is scaling up rapidly.

Similar to other great companies, the reasons behind Venu’s success are based on simplicity. Their focus lies on the complete customer experience and not only on one aspect, like venue design. Everything matters in hospitality and to differentiate yourself from the competition, you need to think differently. By integrating upscale dining, indoor music venues and large-scale amphitheaters, Venu’s leadership team has created a compelling offering with a lot of potential.

In the next sections of the report, we will examine Venu Holdings’ business model, their innovative financing strategies and sources of revenue. Furthermore, the upcoming projects are analyzed thoroughly to provide a robust estimate for future revenue and earnings. The report will conclude with a valuation forecast to derive a fair value estimate for the stock price.

HISTORY & BUSINESS MODEL

Following their initial success with their Burbon Brothers Smokehouse & Music Hall in Colorado Springs, Colorado, Venu’s leadership team began evaluating opportunities to expand to strategic markets, which have many, but outdated competitive offerings. This expansion strategy led to the opening of a second restaurant and indoor music venue in Gainesville, Georgia, in 2023.

The project introduced an element, which will be central for future developments – a proactive collaboration with municipalities to maximize economic impact. According to various economic impact studies, well-placed venues like amphitheaters can contribute up to USD 4.5 billion to the local economy over a decade.[1]

Acknowledging the positive impact of such venues, municipal partners started supporting these initiatives through tax incentives, land contributions, or by offering outright financing. Once commercial terms are aligned, a public-private partnership (PPP) is established to build a high-impact entertainment destination, which should act as an additional risk assessment threshold.

Then, the process of site selection starts, driven by a disciplined and forward-looking approach. Venu Holdings management team only targets markets with limited comparable offerings and evaluates key indicators as household income and demographic trends thoroughly to ensure long-term growth. Furthermore, local development plans must fit to Venu’s overall strategy to safeguard an alignment of interest.

After the Georgia project was completed successfully, Venu started diversifying its platform and opened its first outdoor amphitheater in Colorado Springs. The Ford Amphitheater offers a capacity for 9,570 guests and introduces a premium live entertainment experience, including private suites with firepits and customizable hospitality packages (VIP Parking, Food & Beverage (F&B) services and more).

To fund development and construction in an innovative and debt-efficient manner, Venu and Ford Motors agreed to a 10-yer naming-rights deal and Venu pre-sold private suites to customers and/or investors through a fractional ownership model. In case of the Ford Amphitheater, a total of USD 30M could be raised. For venues currently under construction, Venu remains on track to reach its 2025 goal of raising up to USD 200 million, as monthly FireSuite pre-sales continue to exceed USD 15 million this year.[2] Fractional ownership benefits typically include annual returns of around 4% (up to 12% with secondary ticket sales), pass-through depreciation for tax purposes and incentives like preferred parking.[3]

Going forward, Venu is expanding further into markets with high potential in Texas and Oklahoma. Amphitheater developments are underway in McKinney, El Paso, and Broken Arrow. Every project is driven by Venu’s core principle of enhancing the holistic customer experience and introduce upscale elements and services.

Simultaneously, the company continues to expand its F&B operations , with new concepts such as Roth’s Seafood and Chophouse. The upmarket restaurant will offer an elevated dining experience, including a full-service craft cocktail rooftop bar. However, each offering should not be seen as standalone solution, because all of Venu’s businesses are designed to integrate seamlessly into their broader campus environment.

In summary, Venu Holding’s business model combines development, construction and operations within its entertainment-campus platform. Markets are selected only if strong alignment with municipal priorities and long-term scalability is ensured. Then, longstanding and mutually beneficial collaborations can be formed to maximize local economic impact. A key enabler in this regard is Venu’s fractional suite ownership model, which drives early capital formation and helps create a community.

Once venues go live, each site generates diversified and recurring revenue through profit-sharing agreements with well-established event operators like AEG Presents and Aramark (NYSE:ARMK), a nationally scaled operator with a history of quickly activating large venues, and through additional sources like F&B offerings, sponsorship, parking and more.

MANAGEMENT & BOARD OF DIRECTORS

Venu Holdings Corporation is managed by its founder and CEO J.W. Roth, who was behind the company’s strategy from its inception onwards and continues to shape its execution. His approach focuses on integrating entertainment offerings with regionally anchored real estate to generate recurring economic value. This concept was first implemented in Colorado Springs, where an initial proof of concept was achieved. Subsequent expansion efforts have supported Venu’s philosophy, which incorporates operational discipline and strategic foresight.

Roth’s diverse background and his experience in public and private entrepreneurial ventures, combined with an ability to recruit and align senior talent, has enabled Venu to grow in a structured and goal-oriented manner. Therefore, Venu’s leadership team showcases a balance of industry-specific expertise and institutional capability.

President Will Hodgson is responsible for driving Venu’s long-term growth and builds on a significant track record in live event operations, including senior roles at Live Nation and Front Gate Tickets. CFO Heather Atkinson has been involved as CFO of Venu since its inception in 2017 and maintains financial oversight, ensuring regulatory compliance and continuity. Furthermore, operational depth has been strengthened by the recent addition of Vic Sutter as EVP of Operations, whose experience in premium food and beverage is seen as critical in the context of Venu’s vertically integrated hospitality model.

Adding to the strength of the executive team is Terri Liebler, who joined as Chief Marketing Officer in December 2024 and was quickly promoted to President of Venu’s newly established Growth and Strategy division. She is now focused on driving strategic development, scaling operations, and enhancing long-term shareholder value. With more than 30 years in sports and entertainment marketing, including senior sponsorship and venue-launch roles at Live Nation and the NBA, she brings proven capability in brand elevation and profitability enhancement to the team.[4]

The leadership structure’s sum total reflects a combination of entrepreneurial drive and professional management to support the long-term evolution of Venu’s business. Therefore, we remain confident that the expansion strategy can be executed as planned and a focus on brand enhancement and profitability will maximize shareholder value.

MARKET SIZE & COMPETITIVE LANDSCAPE

The U.S. market for live music, including concerts, festivals and events, is growing rapidly. According to Mordor Intelligence, the size of the U.S. live music market is estimated at USD 15.6 billion in 2025 and is expected to grow at around 8.6% annually until 2030 and beyond.[5]

Even more important, per capita spending on live music in the U.S. hit a new record of USD 281.- in 2024, implying a growth of 17% versus 2023.[6] These figures illustrate that live-music spending has proven to be more robust than other formats in the industry, as a slowdown was widely expected according to the research firm MusicWatch.

Although this development can mainly be explained by a nationwide increase in disposable income, other structural changes like a shift towards experience-based spending should be taken into account. Creating memorable – and digitally shareable – experiences by going on adventurous travels or by attending extraordinary events top bucket lists of millennials and younger generations (Gen Z).[7] However, also wealthy and recently retired baby-boomers are discovering new ways of recreational spending.

Therefore, we expect that the travel & leisure industry will prove to be more robust going forward, mainly supported by structural shifts and supportive demographics.

As market size and long-term growth rates are creating a significant tailwind for Venu Holdings’ growth, an assessment of the competitive landscape is needed to verify, if Venu is able to grow faster than the market by growing its market share.

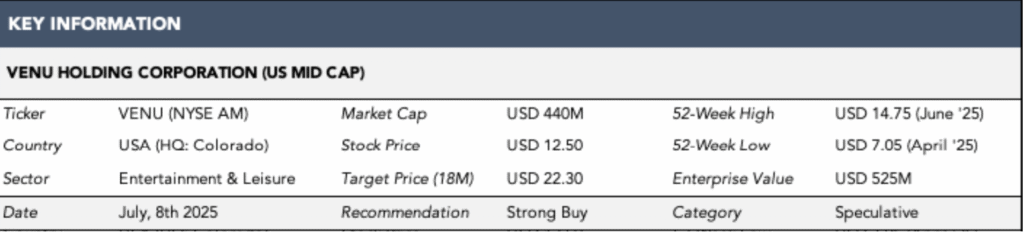

As table 1 illustrates, Live Nation (Ticker: LYV) dominates the U.S. live entertainment landscape, especially through its Ticketmaster platform and Live Nation Concerts. Across the nation, the company operates more than 150 venues, including amphitheaters. Live Nation generated USD 23 billion in revenue last year and highlights an annual revenue growth rate of 9.1% over the last five years (CAGR). Through its dominance and broad operations, which range from venues, ticketing and food & beverage offerings to artist management and advertising solutions, Live Nation captures around 60% of the U.S. market share. Although LYV is mainly present in large and medium-sized metropolitan areas, they started pushing into underserved cities as well – posing a possible threat to Venu Holdings’ business model. Live Nation is allocating an estimated USD 900 million to USD 1 billion in 2025 capital for its venue expansion plans.

Furthermore, AEG Presents is another worthy competitor, which remains privately held and belongs to AEG Worldwide (Anschutz Entertainment Group), a global sports and live entertainment conglomerate. AEG Presents focuses exclusively on concert promotion, music festivals and venue management and maintains a strong presence in large cities like Los Angeles, New York and Chicago. Its key focus lies on festival production and promotion. As privately held company, most figures remain unknown. However, based on publicly available information it can be stated that AEG Presents captures a significant market share (around 20%) in the U.S. and generates USD 0.5 billion in revenues per annum.

A smaller, but noteworthy figure in the live entertainment space is CTS Eventim. Although mainly known within Europe (headquartered in Germany), the company is gradually tapping into the U.S. market. They do not own any venues yet but provide ticketing infrastructure and selective event promotion via its EMC Presents joint-venture and through the acquisition of Vivendi’s ticketing arm.

In summary, the U.S. market for live entertainment is concentrated but remains regionally diverse. Albeit strong competitive forces and large barriers of entry, Venu Holdings positioned itself well by focusing on underserved markets with little or no competition. Furthermore, their integrated concept of providing a top-notch customer experience through their entertainment campuses serves as key distinguishing factor and highlights Venu’s unique selling proposition (USP). Still, competition remains vigilant and further pressure can be expected, as industry giants like Live Nation are exploring underserved markets as well.

However, Venu’s independent execution model, which allows the company to choose and leverage partnerships selectively, helps mitigate competitive forces. For example, Venu has partnered with AEG Presents for its first amphitheater (Ford Amphitheater) in Colorado Springs. AEG Presents manages event programming and operates the venue, while Venu retains ownership of the amphitheater and receives a share of revenues. In addition, the company has confirmed a constructive working relationship with Live Nation and is actively exploring future collaborations in markets, which are currently under development.

This smart move ensures that Venu not only benefits from AEG’s platform and reach but also improves operational efficiency by avoiding capital-intense promotional spending. Even more importantly, competitive pressure is softened, as partnering with established players reduces the risk of facing new entrants in a region. CEO Roth has emphasized that relationships with firms like AEG and Live Nation are seen as strategic building blocks and not competitive threats, as each company has a role to play in realizing Venu’s broader vision for redefining live entertainment.

FINANCIAL OVERVIEW & REVENUE FORECAST

Figure 1: Venu Holding 2024 Revenue Breakdown

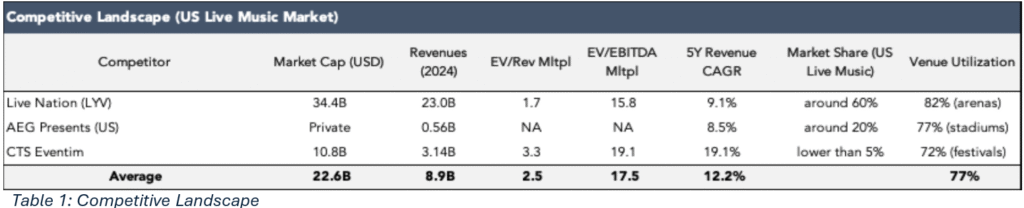

To understand Venu Holdings’ financial figures, key drivers of revenues must be determined. Subsequently, a revenue forecast can be modeled based on planned expansion (product pipeline) as well as by adjusting utilization rates to reflect long-term industry averages.

In 2024, Venu Holdings generated an annual return of USD 17.8 million, which consisted mainly of restaurant operations (F&B) as figure 1 shows. Around a third of the revenue was made via event operations, including ticket sales and venue rentals and the remaining 9% came from business activities in relation to the Ford Amphitheater.

By analyzing last years’ revenue figures, it becomes clear that new ventures (Ford Amphitheater) did not make a large impact yet, as it was opened in August 2024. Going forward, existing and planned venues will drive revenues and therefore, lead to a massive growth.

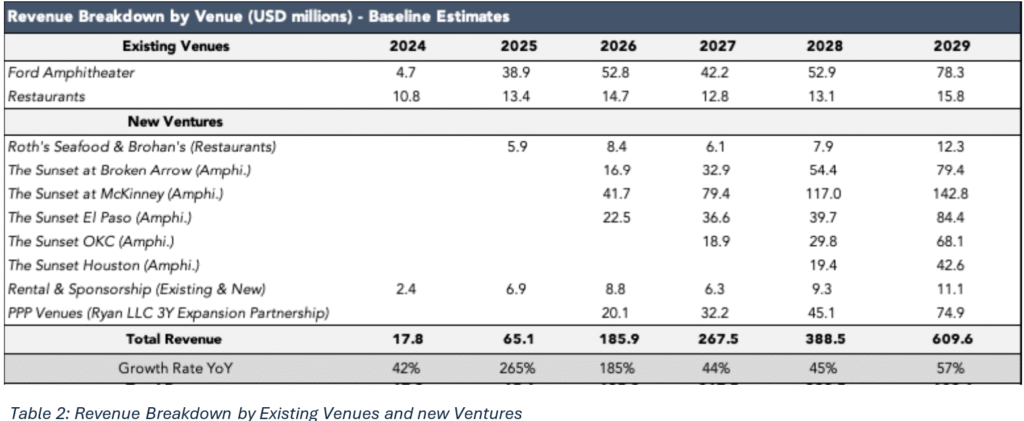

Table 2 features a revenue breakdown by venue and includes a forecast for the period of 2025 to 2029 based on opening dates and utilization rates. To provide a realistic picture of future revenue streams and respective growth rates, we apply the industry-standard 20% utilization rate for new amphitheaters in their opening year and increase those figures accordingly in the subsequent years until a long-term utilization rate of around 77% is achieved. Capacity limits are modeled to be reached by 2029, based on a total of 79,570 available seats, to match Venu Holdings’ investor guidance, which was announced this spring.

However, given more recent releases, the company now plans to triple this figure by adding over 20 new venues within the same timeframe.[8] This accelerated expansion is mainly driven by its partnership with Ryan LLC, a specialist in economic development and incentive structuring, which helps Venu identify suitable locations, secure favorable terms, and streamline public-private partnerships (PPPs).

As this three-year partnership is still developing, we remain cautiously optimistic in our total assessment. To acknowledge, however, that another significant source of revenue is materializing, we expand our revenue breakdown by adding PPP venues (via the Ryan LLC partnership) to our estimates in table 2. A first impact of venues, which are opened under this agreement, can be expected in the second half of 2026 at the earliest, considering shortened timelines for negotiations, planning and construction. We expect additional revenues to increase from around USD 20 million to USD 75 million in 2029 and must highlight the fact that meaningful room for upside still exists, if Venu Holdings stays on track with execution and brings its total seating capacity closer to their upper end of current projections of 250,000.

As another input parameter, we apply an average rate for tickets of USD 150.-, which is slightly below the average price of USD 156.- per ticket for the 20 shows held at the Ford Amphitheater in fall 2024.[9] However, as regional differences for new ventures need to be considered in the forecast, we assume a slightly lower average ticket price are reasonable. Furthermore, a 5% annual increase going forward to reflect inflation and upscale status was taken into account. Premium pricing can be justified by luxurious amenities (i.e. FireSuites) and integrated dining experiences.

As more ventures go live within the next two to three years, we expect gross revenues to increase from USD 17.8 million to around USD 610 million by the end of 2029 in our baseline scenario. As shown in table 2, the main revenue drivers are the upscale amphitheaters, opened in upcoming regions. In contrast to the current revenue breakdown (figure 1), restaurants’ impact on revenues will decline steadily from 61% to 5% until 2029. Thus, valuation approaches need to reflect that the business model is evolving – from being a restaurant owner-operator towards an integrated and diversified live-entertainment corporation. Higher margin operations like event hosting, ticket sales and sponsorship will be key drivers of revenue growth for the years 2025 and beyond.

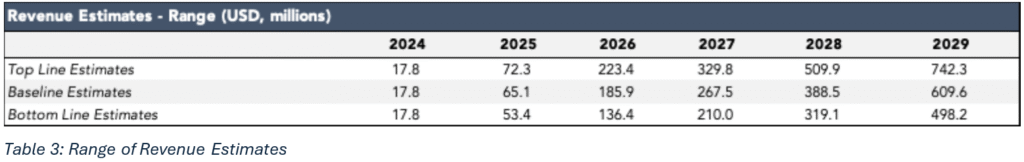

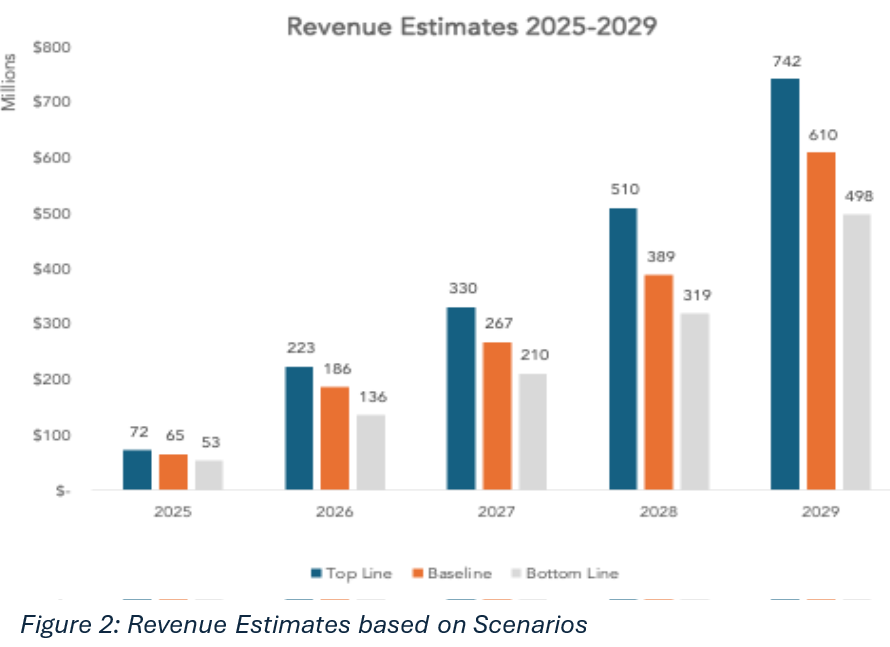

In comparison to managements’ pro-forma forecast, which is based on available information in 2025, our baseline estimate models a more exponential growth path until full capacity is reached in 2029 to account for possible delays in construction and a nationwide slowdown in spending. To consider a broader range of scenarios, input parameters were adjusted to create a top and bottom line estimate until 2029 as well. The obtained forecasts are summarized in table 3.

It becomes apparent that Venu Holdings’ disciplined process, which follows strict selection criteria to find lucrative markets with little, or zero competition pays off, even in a less optimistic scenario. Thanks to the confirmed pipeline of upcoming venues and an innovative financing approach, which minimizes the need for excessive amounts of debt, we expect that Venu can generate at least USD 500 million in revenue from its operations by 2029.

Figure 2 shows a graphical representation of the modeled revenue estimates for the entire forecast period. It becomes evident that under more optimistic assumptions (top line), next year’s revenues can reach USD 223.4 million, implying a growth rate of 209% compared to our estimate of USD 72.3 million for 2025. In all of the three scenarios, we expect that the largest part of revenue growth takes place in the upcoming two years, as most new venues will be live by the end of 2027. In the following years, annual revenue growth is expected to average 50% across all three scenarios, mainly driven by a steady increase in utilization and high-margin income from sponsorship and events.

PROFITABILITY ASSESSMENT & INVESTMENT VALUATION

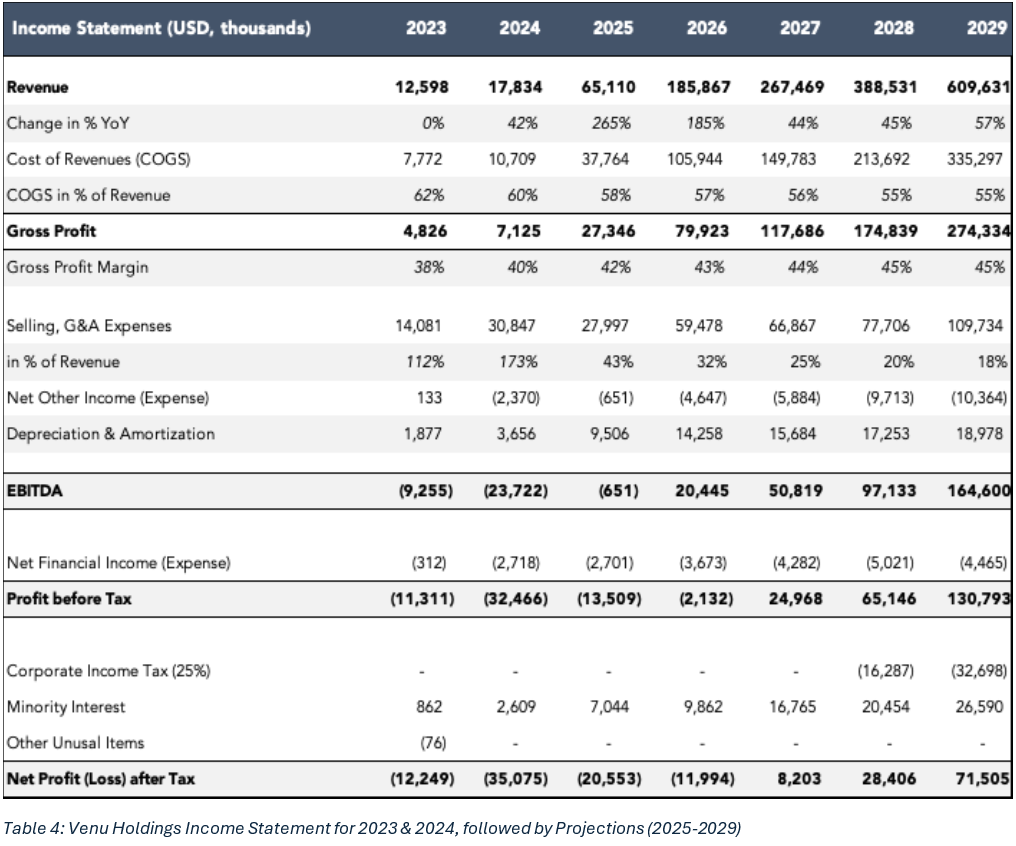

As revenue estimates have been modeled based on managements’ expectations and on our own assessment, we continue with analyzing profitability figures to construct a proper investment valuation for the company and its stock price.

In table 4, the revenue figures from the baseline estimates are used to assess overall profitability. Venu Holdings’ cost of revenue (COGS) is relatively high, ranging from 62% to 55% of revenue. However, these costs are largely a reflection of the operational intensity of Venu’s integrated business model, which combines elements of entertainment, hospitality services (F&B) and venue ownership. Moreover, outsourced event management and backend operations to AEG lead to lower margins but keep total overhead and balance sheet expansion in check.

In our forecast, we expect cost of revenue to decline consistently as average utilization rates rise, and a higher share of high-margin revenue items (naming rights, sponsorship) materializes. Therefore, we expect gross profit margins to increase from 38% in 2023 to 45% in 2029.

Quite typical for a rapid growing company is that SG&A expenses exceed revenues. A large part of Venu Holdings’ SG&A expense for 2024 was related to building its operational infrastructure, before the Ford Amphitheater was opened in August of the same year. Therefore, a large portion of costs like staffing, branding and promotional outlays incurred, before main revenues from ticketing or F&B operations could have been generated. Going forward, we expect SG&A expenses to decline relative to revenue, leading to a positive EBITDA in 2026.

As EBITDA turns positive after most venues go live and generate a substantial share of total revenue, overall profitability improves, supported by stronger margins and declining up-front expenses. It can be expected that a positive bottom line figure (net profit after tax) can be achieved as early as 2027. A negative carryforward should limit the tax burden at least for 2027, likely for 2028 as well. Still, even if income tax expenses are considered for 2028 and beyond, net profits could exceed USD 20 million and double in the following years. If our baseline scenario proves to be too conservative, a profit before tax could be achieved even in 2026.

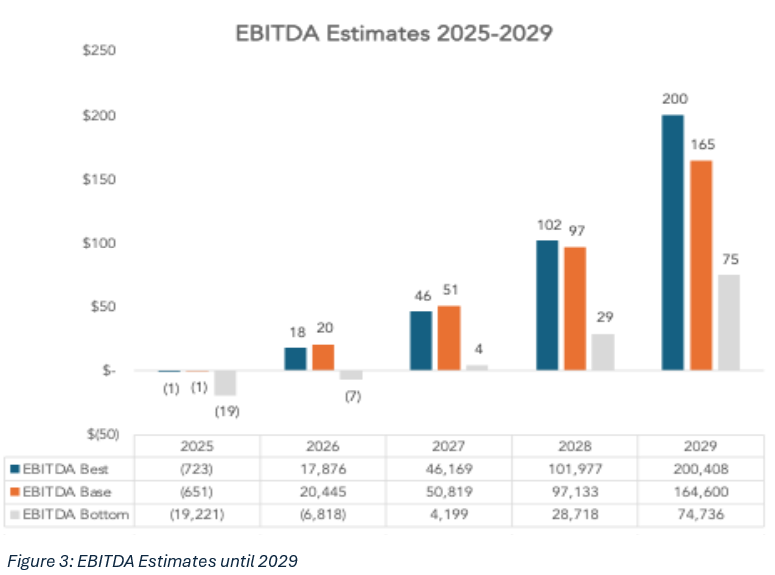

Figure 3 illustrates EBITDA forecasts under the three different scenarios. In a less optimistic scenario (bottom line estimate), we expect larger SG&A outlays also for 2025, combined with a slower increase in revenues due to operational delays and longer construction periods. However, even under those assumptions, EBITDA turns positive in 2027 and increases steadily in the subsequent years.

The optimistic scenario is marked by more aggressive developments and promotion, which accelerates revenue growth but also upfront costs. Thus, EBITDA figures exceed our baseline figures only marginally in 2028, but the gap starts to widen from the years of 2029 and beyond.

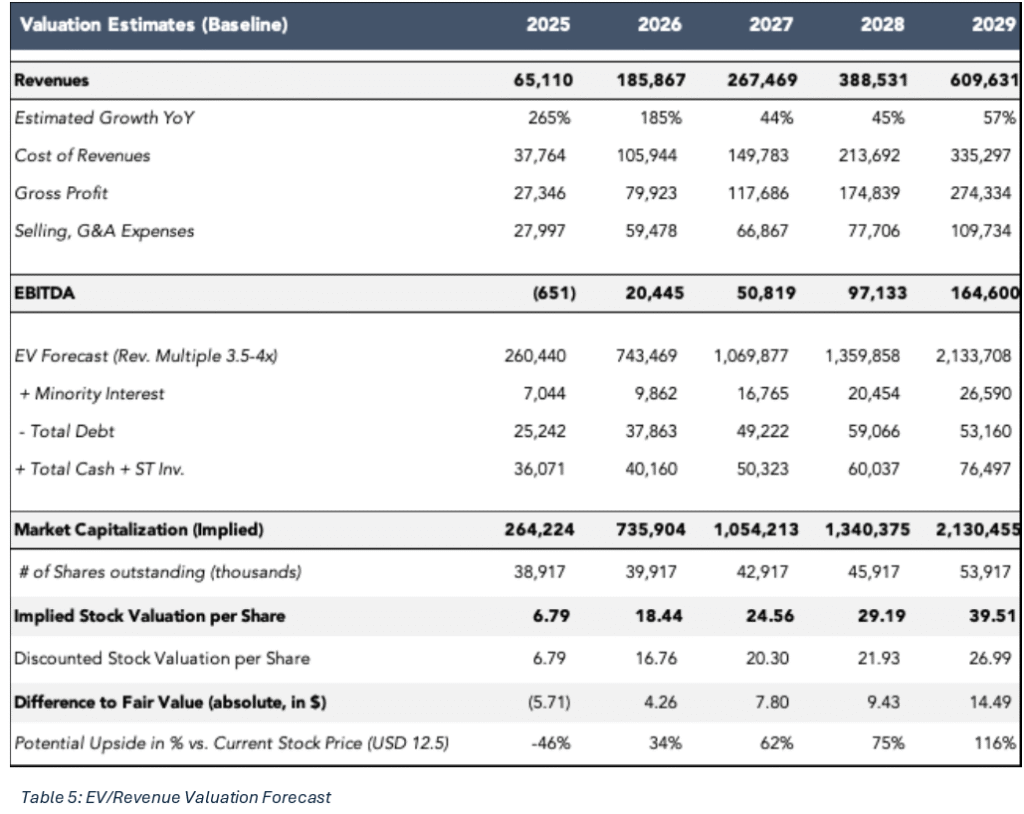

Strong revenue growth and an increasing EBITDA figure allows for a revenue-based valuation approach, using an EV/Revenue multiple of 4 until 2027 and 3.5 afterwards as growth matures. Based on calculations shown in table 5, implied enterprise value is expected to increase from USD 260 million to USD 2,134 billion by the end of our forecasting period. Adjusted by minority interest, debt and liquid holdings the market capitalization of Venu Holdings should increase alongside revenue.

Applying the roughly 39 million common shares outstanding, implied stock valuation figures can be derived. Comparing those fair value estimates to the current level of the stock price (USD 12.5) indicates that Venu is currently trading 34% below its discounted fair value for 2026 (16.76).

The 2025 fair value figure of USD 6.79 mainly reflects historical developments and should only be considered if no further ventures are operating than the Ford Amphitheater and Roth’s Chophouse. As financial markets incorporate future developments, we consider the implied fair value for the years 2026 and 2027 more relevant and base our recommendation on these figures. Otherwise, the medium-term trend and upside potential would be neglected, leaving to an inaccurate forecast.

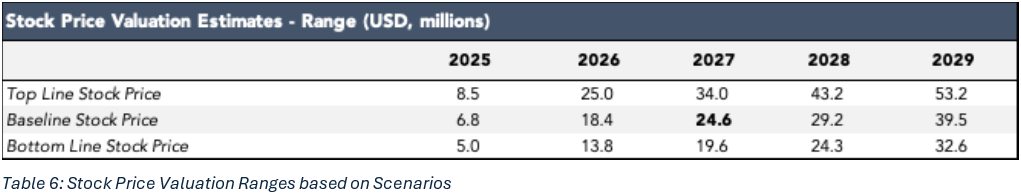

Furthermore, valuations ranges are applied as well to account for different scenarios. Table 6 contrasts the three different scenarios and shows that Venu is currently trading below its 2026 fair value estimates, even under the bottom line scenario. Therefore, even if construction delays or a brief recession materialize, the existing margin of safety should limit downside losses considerably.

Another positive aspect in this regard is that Venu Holdings has received a SEC approval to issue up to 4,75 million preferred stocks at a price of USD 15, which allows them to raise around USD 72 million to fund their projects – without diluting common stockholders in the near future. The convertible stocks (agent warrants) come with a cumulative 8% annual dividend, are convertible on a 1:1 basis and redeemable after 5 years. This authorized capital raise supports our growth assumptions and offers flexibility of funding without increasing debt.[10] While a conversion is not guaranteed, we assume full conversion as part of our more conservative baseline estimate. Therefore, share count is expected to increase steadily from 39 to 54 million until 2029 to account for conversion and additional share issuance.

In addition to our EV/Revenue based approach, we incorporate an EV/EBITDA valuation to verify our findings. Based on industry averages and figures from competition (see table 1 for reference) we consider multiples of 14 to 15 applicable. As EBITDA turns positive after 2026 and exhibits strong growth in the following years, the EV/EBITDA based approach implies marginally lower valuation levels for 2026 and 2027 but points to higher upside in 2029 (43.7 vs. 39.5).

To conclude, we base our recommendation for this high-stage growth stock on the EV/Revenue approach as it acknowledges fast revenue growth more appropriately. As our forecasts have shown, profitability (in form of EBITDA and net profits) follows as utilization rates improve, and revenues exceed upfront costs. Therefore, we grant Venu Holdings a strong buy rating and set the year-end 2026 price target for its stock to USD 22.3. Our valuation is based on the fair value estimate for 2027 (USD 24.6), which has been discounted by one year with a 10% discount rate to reflect the estimate in 2026. Our investment horizon was increased from 12 to 18 months to incorporate most of the anticipated progress in revenue growth and margin improvements.

Thus, the stock price should begin to reflect the outlined growth trajectory if management continues to deliver on expectations and reinforces the outlook through strong quarterly results and optimistic forward guidance. As noted, even higher implied valuations, such as the top-line estimate of USD 34 for 2027, are within reach if the accelerated expansion plan tied to the Ryan LLC partnership begins to materialize as currently envisioned.

RISK CONSIDERATIONS & CONCLUSION

Speculative growth stocks in the mid-cap space come with inherent uncertainty, especially when valuations are driven by optimistic parameters about future growth. Shifts in sentiment, delays in execution, or changes in consumer spending can weigh on performance, even if the long-term potential remains intact. However, that statement is relevant for every company listed on the stock market.

All in all, Venu Holding Corporation offers a unique business model, shows strong early traction and offers a promising roadmap for expansion. Their core thesis is built on disciplined execution, innovative financing, and a growing footprint of venues that aim to redefine the live entertainment experience in underserved regions.

Much like attending a live performance, expectations for this investment are high, and the stage is set for something remarkable. But as with any show, success depends on many moving parts, like the location, the artistic performance, the weather and quite importantly, the timing. Sure, a few things can go wrong along the way. But if everything comes together, it can turn into something great. That’s why it’s worth watching Venu Holdings closely – and maybe consider buying a ticket to a show. Or invest in an upscale FireSuite. Or in some shares – the choice is yours.

LEGAL INFORMATION & DISCLAIMER

This valuation report expresses the views of the author as of the date indicated and such views or assumptions are subject to change without notice.

One of our independent analysts authored this report on Venu Holdings Corp using publicly available sources and reflecting personal views of the company. The compensation for writing and publishing this report has not influenced the outcome of this analysis. While every effort has been made to ensure the reliability of the information used, readers are advised to conduct their own due diligence to obtain the most current publicly available information. It is important to consider that overall compensation does create an inherent conflict of interest when reading this report.

The valuations presented are based on both current and forward-looking statements, intended to provide investors with valuable insights into the company’s current and future business prospects. This report does not imply or guarantee past or future performance. The content, including reports, articles, and company materials, is for informational purposes only and should not be considered an offer to buy or sell any securities mentioned.

The author has no duty or obligation to update the information contained herein. Further, the author makes no

representation, and it should not be assumed that past investment performance or any kind of forecast is an indication of future results.

Any kind of investment in financial securities is inherently risky and can lead to a loss of the capital invested. Thus, this valuation report is being made available for educational purposes only and should not be used for any other purpose. The information contained in the report does not constitute and should not be construed as an offering of advisory services or an offer to sell or a solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein

Concerning economic trends and performance, is based on or derived from information provided by independent third-party sources. The author believes that the sources from which such information has been obtained are reliable, however, its accuracy cannot be guaranteed. Furthermore, any kind of information or assumption in this report has not been independently verified and hence should not be considered completely or accurate. The author of this report has been compensated on behalf of 247MN for this unbiased investor presentation. Analyst coverage and press materials can cost up to $5,000 per quarter for continuous coverage. Contact editor@247marketnews.com for more information.

This valuation report contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding the Company’s ability to grow its business and other statements that are not historical facts, including statements which may be accompanied by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “Estimates,” “aims,” “believes,” “hopes,” “potential” or similar words.

This report was commissioned on behalf of Venu Holdings by 247marketnews.com who is contracted with Microcap Advisors for the continued coverage of the company. Neither the analyst CENORIUM (SASCHA) nor 247marketnews or will be trading VENU HOLDINGS at any time surrounding the release of this report. 247 Market News has been compensated for the release of this report by Micro Cap Advisors who is currently contracted with the company. 247MN expects to continue analyst coverage throughout the construction phase and will continue to update interested readers on an ongoing basis.

For more information or corporate communications coverage contact editor@247marketnews.com

The forward-looking statements contained in this valuation report are made as of the date of this report, and the Company does notundertake any responsibility to update such forward-looking statements except in accordance with applicable law.