DALLAS, TX -- May 2nd, 2024 -- Independence Contract Drilling, Inc (NYSE: ICD): Stonegate Capital Partners updates coverage on Independence Contract Drilling, Inc.

COMPANY UPDATES

ICD continues to position itself for long-term growth while maintaining impressive operating results despite the softness seen in the market overall. The Company saw year-over-year revenue decrease by 27% and Adj. EBITDA decreased by 45%, both of which outpaced market expectations. We do not expect any rig reactivations until 2H24 at the earliest while ICD spends the first half of 2024 focusing on navigating market churn.

- Operating Days and Margin: ICD exited 1Q24 with 18 activated rigs and an average rig count of 15.3. Dayrates averaged $30,313 and margins were $11,829. Revenues for 1Q24 were $46.6M, representing a 26.9% decrease as compared to revenues of $63.8M 1Q23. ICD ended 1Q24 with a backlog of $69.4M.

- Quarterly Results: ICD reported revenue, adj EBITDA, and EPS of $46.6M, $11.8M, and ($0.62), respectively. This compares to our/consensus estimates of $40.6M/$41.6M, $8.3M/$9.2M, and ($0.92)/($0.91), respectively. Both revenue and gross profit were above our expectations. Operating expenses were also above expectations due to lower than expected SG&A expenses, leading to a higher Adj. EBITDA than modeled.

- Permian Basin Remains Stable: Despite the current macro environment, the Company continues to see some stability in the Permian Basin. The Company currently has between 13-14 rigs operating in the Permian, with an additional rig expected to begin operating in 2Q24. We note the excessive churn in the market from consolidation is leading to an increase in downtime and costs associated with moving rigs.

- Headwinds in Haynesville Market: The Company continues to see weakness in the Haynesville market, along with the rest of the industry. While management believes that this market can see a rebound in FY25, they acknowledge the reality of the situation and took an opportunity to move another rig into the Permian Basin. This leaves two operating rigs in the Haynesville market, with one additional rig remaining idle.

- Debt Goals in Focus: ICD ended the quarter with liquidity of $20.4M between the $6.9M cash balance and $13.5M revolver availability. Management continues to prioritize de-leveraging as a strategic priority, and we expect this to continue over the coming quarters. The Company has elected to PIK the interest due and payable in September. Management has turned its focus on the refinancing window that opens later this year for the Convertible Notes that are due in 2026 by appointing a special independent committee to begin the review and evaluation process. We see significant upside to ICD’s valuation once its balance sheet has been right sized.

- Valuation – We use both an EV/EBITDA and EV/Rig comparison for our valuation of ICD.

- We are using an EV/EBITDA range of 3.5x to 4.0x. To arrive at a valuation range of $3.08 to $5.19 with a mid-point of $4.13.

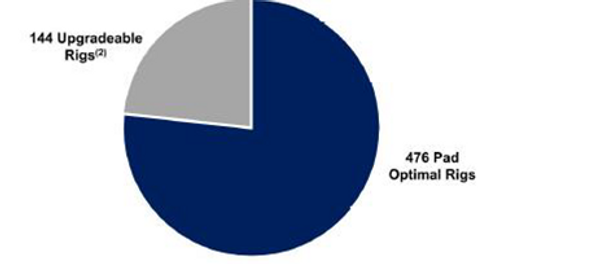

- When we apply an EV/Rig multiple range of 7.0x to 9.0x with a midpoint of 8.0x to ICD's 26 marketable rigs it arrives at a valuation range of $1.21 to $4.91 with a mid-point of $3.06.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.