Five New Mineralized Target Areas Identified at Silver Dollar's La Joya Project in Durango, Mexico

Surface samples assayed up to 1,218 g/t AgEQ, and three of five target areas have never been drill tested

February 22, 2023 8:30 AM EST | Source: Silver Dollar Resources Inc.

Vancouver, British Columbia--(Newsfile Corp. - February 22, 2023) - Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) ("Silver Dollar" or the "Company") is pleased to provide an update on its new target development work at the underexplored Noria portion of the La Joya Silver Project (the "Property") located in the state of Durango, Mexico.

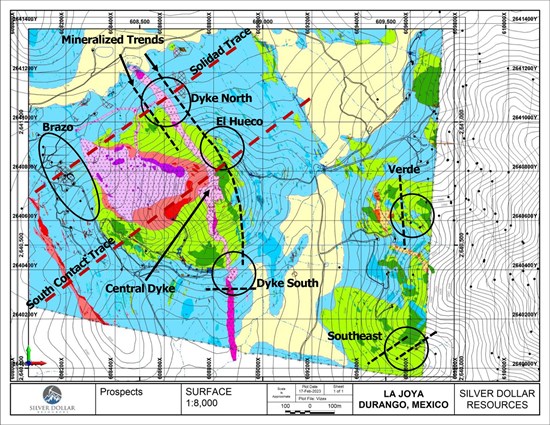

Figure 1: Coloradito-Noria Mineralized Targets.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7232/155717_6f3e4af1047e79e3_001full.jpg

"Our field crew has done a great job locating additional hot spots for drilling," said Mike Romanik, president of Silver Dollar. "It's intriguing to find such high-grade assays in and around some of these areas which have never seen a drill hole."

Geological mapping has now been completed to cover all of the Coloradito-Noria ground at a 1:1,000 scale. A total of 125 rock samples were collected from outcrop and rock dumps and submitted to the lab for analysis. Results for all samples have now been received, 79 sample assays were previously reported (see news release of December 15, 2022), and the balance of the sample results are reported herein.

The mapping and sampling program has identified five mineralized areas (see Figure 1): the Verde and El Hueco areas were partially drilled by a previous operator, and the Dyke North, Dyke South, and South-East areas have never been drill tested. A summary of each area follows:

Verde Area:

Verde (see Figure 2) is a historical surface occurrence with visible copper mineralization and where three historical holes were drilled at 045° (LJ-DD-11-11, 12 & 13). The best assay results from this area were chip sample #120 (see Photo 1) that returned 415 grams per tonne (g/t) silver equivalent (AgEQ) over 0.3 metres (m), and chip sample #121 that returned 1,218 g/t AgEQ over 0.3 m. Both samples strike north and north-northwest dipping to the west. Historical hole LJ-DD-11-11 was collared near these samples but missed the surface mineralization as it was targeting a deeper area. A better understanding of this structure down dip to the west and its relation to the nearby "Dique Viejo" dyke, could provide better guidance to justify follow-up drilling of this target.

El Hueco Area:

Hueco Grande (see Figure 3) is a significant historical working on a structure with a true width of at approximately 3 m wide and mined to a depth of 15 m (see Photo 2). Grab sample #16 was a composite sample taken over 5 m of dump material that assayed 391 g/t AgEQ. Assuming safe access into the workings can be established, proper mapping and sampling will be done. The extension of these workings could be targeted from an existing drill pad 55 m to the northeast.

Dyke North Area:

Dyke North mineralization (see Figure 4) is located within and around the northern extension of the Central Dyke Zone. Here mineralization has been identified in three parallel zones: within the dyke, 70 m to the east of the dyke in the foot wall, and 20 m to the west in the hanging wall.

The North Hanging Wall is defined by a series of small pits (see Photo 3) over a 105 m strike length where six samples assayed 474 g/t AgEQ (dump #91), 148 g/t AgEQ over 1.5 m (chip #92), 82 g/t AgEQ over 0.6 m (chip #93), 96 g/t AgEQ over 1 m (chip #90), 113 g/t AgEQ (dump #24), and 50 g/t AgEQ over 0.6 m (chip #25). These pits all have poor and sloughed-in conditions that will be investigated further.

Mineralization within the intrusive dyke has been identified in dumps and an outcrop (see Photo 4) where a dump material sample (#80) assayed 267 g/t AgEQ, and a 0.3 m chip sample (#81) assayed 53 g/t AgEQ. Gold is elevated within the intrusive with a high of 1.88 g/t Au in sample #80. Again, exposure is limited here that will be followed up.

At the North Foot Wall, there are three pits over approximately 50 m paralleling the dyke where grab sample #83 assayed 46 g/t AgEQ, chip sample #82 assayed 453 g/t AgEQ over 1.7 m (see Photo 5), and grab sample #23 assayed 682 g/t AgEQ. These showings are 400 m north of and on strike with Hueco Grande, with samples from three showings in between returning assays of 518 g/t AgEQ (dump #85), 165 g/t AgEQ over 1.6 m (chip #84), and 73 g/t AgEQ over 2 m (chip #22).

Dyke South Area:

In the South Dyke area (see Figure 5), there is the southward extension of the mineralized trace from Hueco Grande 350 m to the north. Chip sample #35 was taken from a small working (see Photo 6) and assayed 305 g/t AgEQ over 1.8 m.

The "South Dyke Au Zone" is defined by six grab samples (#42 through #47) that returned assays of 0.40, 0.26, 0.35, 0.85, 0.56, and 0.31 g/t Au, respectively, over a 25 x 25 m area. These occur within three east-west trending shear zones exposed in a series of low-lying outcrops (see Photo 7). Further mapping and trenching are recommended.

South-East Area:

The "South-East" area (see Figure 6) consists of two parallel structures approximately 100 m apart. The eastern structure is poorly exposed, with the best result coming from a chip sample (#78) that assayed 401 g/t AgEQ over 0.8 m (see Photo 8). The western structure is defined by two collapsed prospect pits with no exposed outcrop. Hand and/or backhoe trenching across both structures could improve the understanding of this area.

Drilling:

In late January, two widely-spaced holes were drilled to target the untested southern extension of the Brazo structure, coincident with the S-3 MAG anomaly (see Figure 7) and near the intersection of major structures. Hole NOR-23-029 was drilled to a total depth of 336 m and intersected a broad >100 m hornfels zone with local concentrations of sulphides. Hole NOR-23-030 was drilled to a total depth of 549 m and cut through a very wide alteration zone with local sulphides throughout the entire 200-m zone. All drill core has been logged with samples from both holes shipped for assay.

Procedure, Quality Assurance / Quality Control, and Data Verification

The diamond drill core (HQ size) was geologically logged, photographed, and marked for sampling. Core designated for sampling was sawn in half with a diamond blade core saw. One-half of the core was sealed in plastic bags and shipped for analysis. The remaining half was returned to the core trays for storage and/or for metallurgical testwork.

The sealed and tagged sample bags were transported to the ActLabs facility in Zacatecas, Mexico, where the samples were crushed and 200- to 300-gram pulp samples were prepared with 90 per cent passing Tyler 150 mesh (106 micrometres). The pulps were assayed for gold using a 30-gram charge by fire assay (Code 1A2 and/or FA450) and overlimits greater than 10 g/t were reassayed using a gravimetric finish (Code 1A3 and/or FA550). Silver and multielement analysis were completed using total digestion (Code 1F2 total digestion ICP). Overlimits greater than 100 g/t silver were reassayed using a gravimetric finish (Code 8-Ag FA-GRAV Ag).

Quality assurance and quality control ("QA/QC") procedures monitor the chain-of-custody of the samples and include the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks, and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this news release have passed Silver Dollar's QA/QC protocols.

Mike Kilbourne, P.Geo., an independent Qualified Person as defined in NI 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company. Grab samples are selected samples and not necessarily representative of the mineralization hosted on the Property.

About the La Joya Project:

The La Joya Property is situated approximately 75 kilometres directly southeast of the state capital city of Durango in a prolific mineralized region with past-producing and operating mines including Grupo Mexico's San Martin Mine, Industrias Penoles's Sabinas Mine, Pan American Silver's La Colorada Mine, and First Majestic's La Parrilla and Del Toro Silver Mines.

Silver Dollar previously reported analytical results for its Phase I drill program, which consisted of 2,424 metres completed over 11 holes (See news releases of March 24, 2022 and May 4, 2022); and for its Phase II program, which consisted of 3,428 metres of drilling completed over 17 holes (See news releases of June 13, 2022, August 17, 2022, and October 25, 2022).

For additional information, click on the Property location map below to watch a short video.

Figure 8: Location of the La Joya Project along with past-producing and operating mines in the area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7232/155717_6f3e4af1047e79e3_002full.jpg

About Silver Dollar Resources Inc.

Silver Dollar is a mineral exploration company that completed its initial public offering in May 2020 and is fully funded with approximately $6.5 million in the treasury. The Company's projects are located in two of the prolific mining jurisdictions in the world. They include the advanced exploration and development stage La Joya Silver Project in the state of Durango, Mexico, and the discovery-stage Pakwash Lake and the Longlegged Lake properties in the Red Lake Mining District of Ontario, Canada. The Company has an aggressive growth strategy and is actively reviewing potentially accretive acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions.

For additional information, you can download our latest presentation by clicking here and you can follow us on Twitter by clicking here.

ON BEHALF OF THE BOARD

Signed "Michael Romanik"

Michael Romanik,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (204) 724-0613

Email: mike@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements." Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/155717