Saxon Capital Group

Invest Now

Raised

$5,375

Days Left

Closed

Business Description

Problem

Power Generation is Struggling to Keep Pace

America’s power grid is facing a serious reliability crisis. Power demand is expected to rise, while power generation is struggling to keep pace with increased electricity usage. The North American Electric Reliability Corporation (NERC) raised concerns for strains to power grid resources. Most of the U.S. electric grid was built in the 1960s and 1970s. Today, over 70% of the U.S. electricity grid is more than 25 years old, and that aging system is vulnerable to increasingly intense storms. Introducing, Energy Glass Solar!

Solution

As humanity responds to global warming, renewable, zero-carbon sources of energy, especially wind and solar energy, are replacing fossil fuels. That requires a new transmission grid. Energy Glass Solar™ creates energy from the sun, through glass, replacing energy needed from the Grid and in some cases sending excess power back to the grid. Energy Glass does not need the Grid to supply energy to a building or home.

Business Model

We intend to distribute our products through in inside direct selling efforts and through third party distributors. Currently we have four persons involved in our direct selling efforts, all of whom work for us on a consulting basis.

In addition to our direct selling efforts, we intend to engage distributors to promote and sell EnergyGlass products in international markets. For example, we have entered into a non-binding Memorandum of Understanding with PROCONSULT SA, a firm based in Spain which specializes in the [development, promotion, sale and installation of photovoltaic products]. The MOU contemplates that PROCONSULT will collaborate with us in the following areas: new business development, commercial promotion, technical consulting, construction of a local showroom in Spain. Per the MOU, they will work with us to promote Energy Glass products in Spain, Switzerland and Germany. This arrangement is subject to the negotiation and execution of a definitive agreement on mutually agreeable terms.

Market Projection

Large Market Potential!

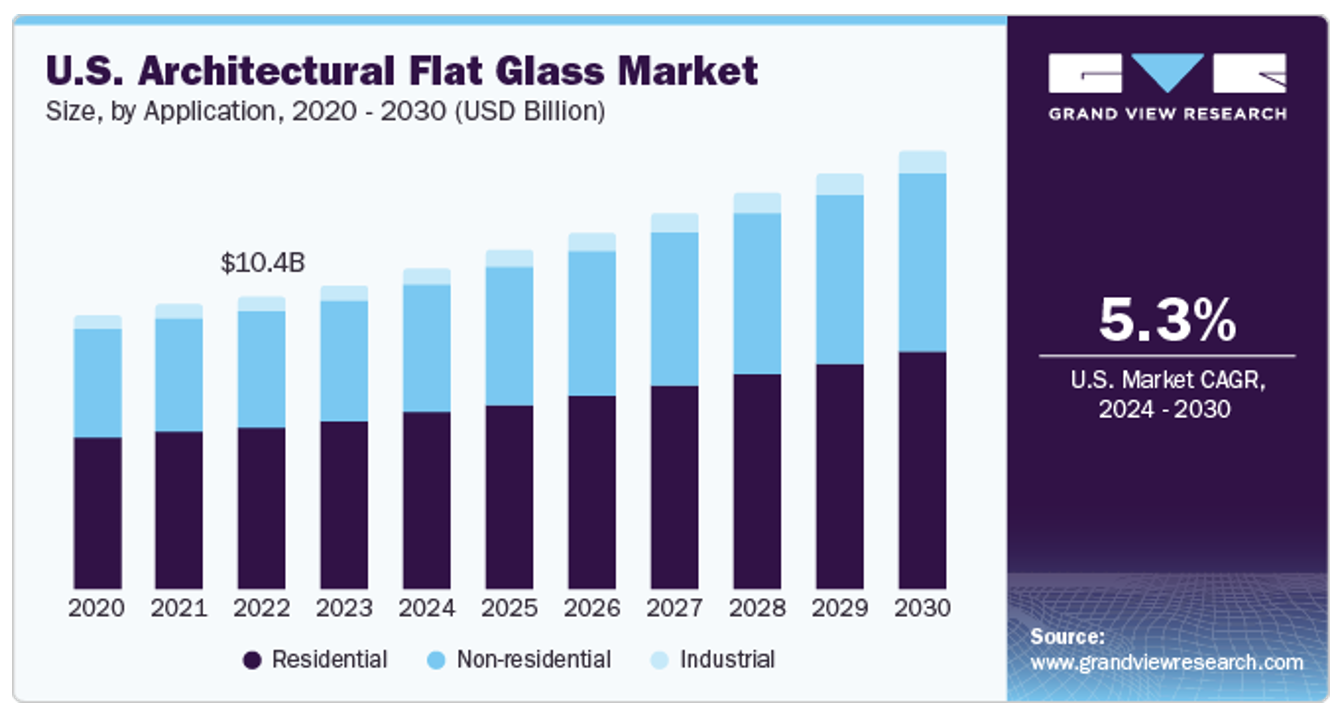

The global architectural flat glass market was estimated at USD 219.41 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030.

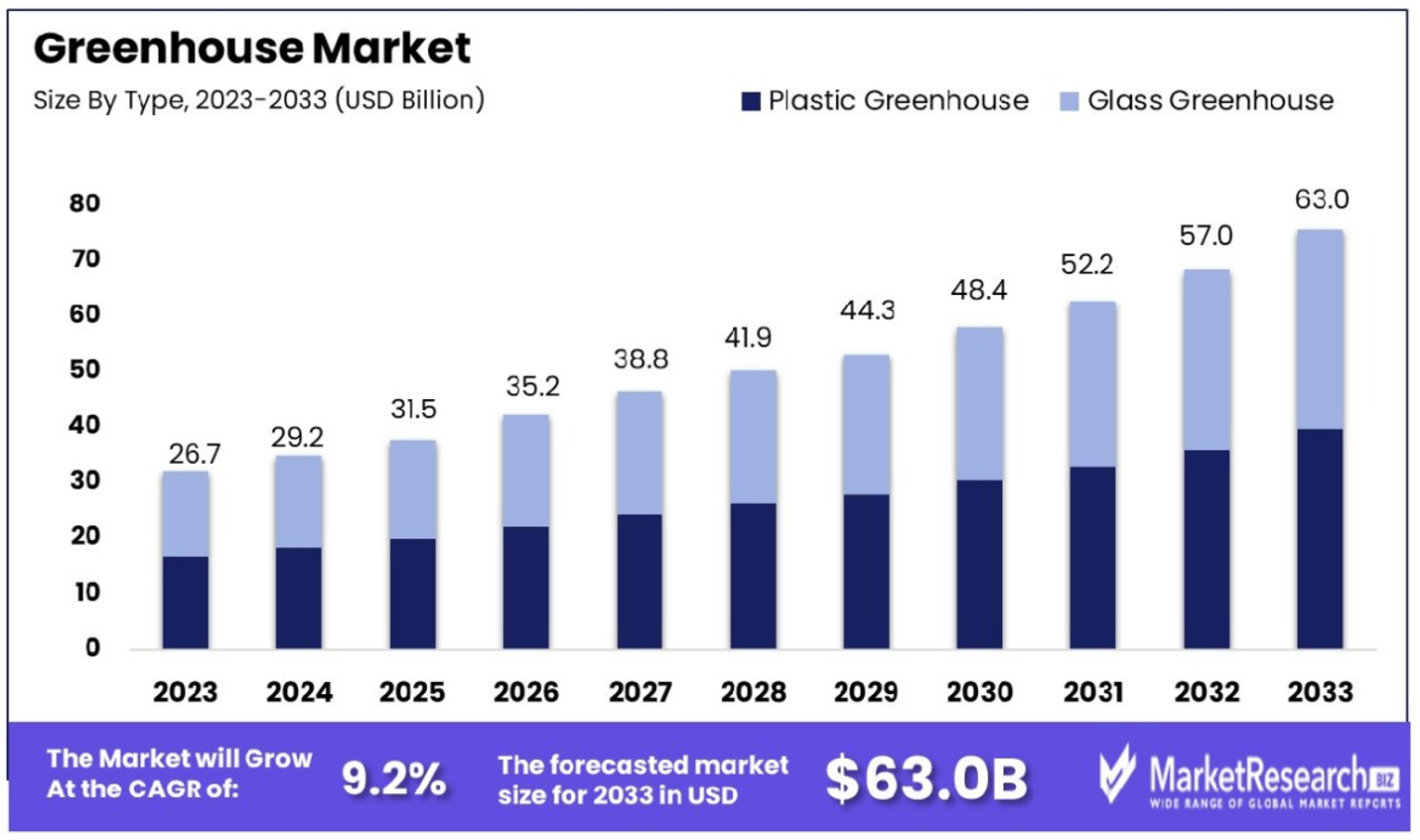

Greenhouses

In a test project in Spain using Energy Glass Solar™, a 5000 sq. ft. greenhouse was powered and grew crops for 4 months, off the grid, producing power solely from the sun. The greenhouse market is projected to expand to $63 billion by 2033.

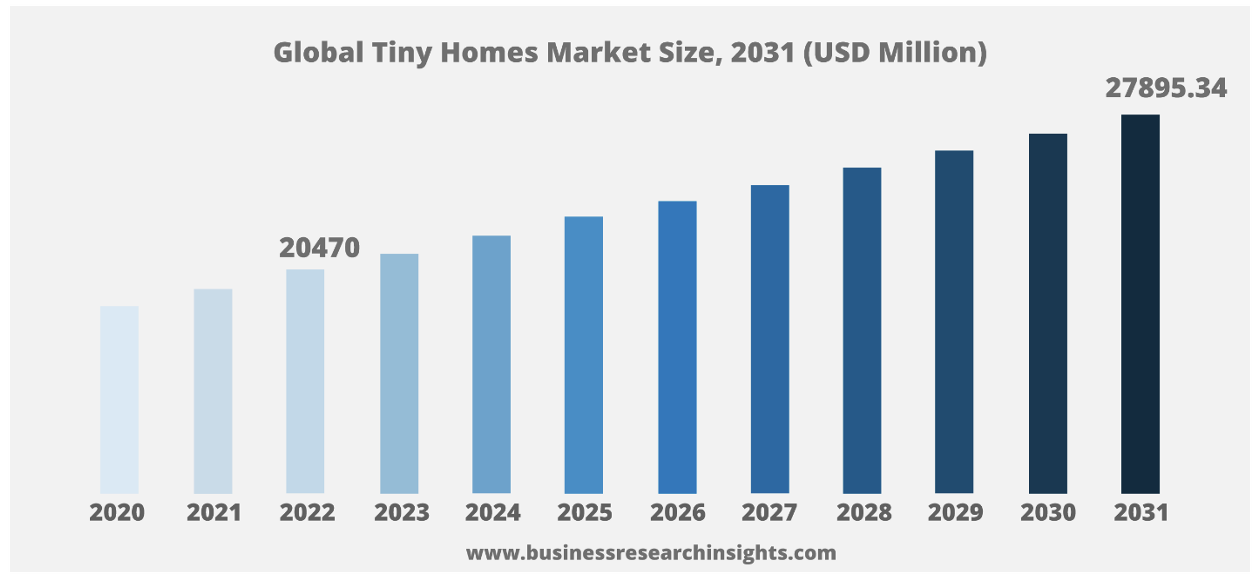

TINY HOME MARKET

The fastest growing segment of the home building market, this segment is projected to be at $27.8 billion in revenues by 2031.

Competition

Energy Glass Solar Stand on Top!

Current competition and solutions to the energy crisis comes from solar panels and windmills. Solar farms take up acres of land that could have better uses and windmills take up both farmland and miles of ocean, killing fish and polluting the waters. Each of these are extremely expensive additions to buildings, greenhouses and homes, where Energy Glass is simply replacing the glass currently used with electric producing glass that reduces the energy drawn from the grid.

Traction & Customers

1. Proven Performance: Successfully piloted at the Sears Tower for 8 years with zero failures, enduring harsh Chicago weather and extreme seasonal variations.

2. Market Validation: Over 50 patents filed, demonstrating technological innovation and leadership in the photovoltaic window sector.

3. Financial Incentives: Qualifies for federal and state tax credits, offering 30% Federal Investment Tax Credit and rapid depreciation benefits, enhancing financial viability.

4. Global Potential: Positioned in a $288 billion worldwide market, with millions in potential orders and pricing comparable to standard plate glass, ensuring competitive advantage and scalability.

Investors

Reason to Invest

Unless you’re a fish living in the water, or caveman living in a cave, every day of your life, no matter where you go or what you do, you see glass. In buildings, homes, boats and automobiles, virtually everywhere you look is glass. Glass is becoming more prevalent in all construction. Double and triple pane glass to protect from heat and cold, colored glass to provide some relief from the sun, and shatter proof, hurricane glass to relieve splatter from breakage. Imagine if all that glass could produce electricity, reducing the use of fossil fuels, reducing the need for large, ugly solar panels and ocean destroying windmills, saving the environment and saving everyone billions of dollars on the cost of electricity. Energy Glass Solar™ is not an addition to a home or building as are solar panels or windmills, Energy Glass Solar™ simply replaces regular glass for glass that creates electricity from the sun. Energy Glass does not take up additional space as does solar panels and windmills, and Energy Glass is not a major additional cost, it’s just a replacement. Energy Glass qualifies for the 30% Federal Investment Tax Credit, greatly reducing the cost of the glass for most users.

By investing in Saxon, you are supporting the development of sustainable housing and contributing to a greener future. Our innovative designs and commitment to quality make us a leader in the green building industry. Join us in revolutionizing the housing market and promoting sustainable living.

- – Destino Ranch https://DestinoRanch.com – Saxon has signed an agreement with Destino Ranch, Arizona for the installation of Energy Glass Solar™ in all buildings on the property as well as building homes to be used as rentals for the complex.

- – Saxon is already trading under the symbol SCGX-OTC

- – Leading edge, patented solar glass technology.

- – $300 billion combined market for products

- – Patented products

- – Glass manufactured by a highly experienced 30-year-old glass company

- – Saxon’s Homes are manufactured by a 25-year-old international home builder.

- – Saxon homes interiors will have Italian Design and Craftmanship designed by Award

- – Winning Aicon Interiors, a division of The Aicon Group, Sicily.

- – Saxon has a partnership with Caribbean International Commerce Holding for development of properties in the Caribbean and Ecuador.

- – Saxon is debt free.

Terms

Up to $124,000 in Common Stock at $2.50 per share with a minimum target amount of $10,000.

Offering Minimum: $10,000 | 4,000 shares of Common Stock

Offering Maximum: $124,000 | 49,600 shares of Common Stock

Type of Security Offered: Common Stock

Purchase Price of Security Offered: $2.50 per Share

Minimum Investment Amount (per investor): $250.00

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $250.00. The Company must reach its Target Offering Amount of $10,000 by April 30, 2025 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

Equity Security

Price Per Share

$2.50

Shares For Sale

49,600

Post Money Valuation:

$118,356,590

Investment Bonuses!

Bonuses:

Reward Incentives:

Invest $5,000+ and receive a $500 discount on Saxon Capital Group Tiny Home.

Invest $10,000+ and receive a $1,000 discount on Saxon Capital Group Tiny Home.

Invest $25,000+ and receive a $2,500 discount on Saxon Capital Group Tiny Home.

Amount-Based Incentives (Bonus shares to be issued by the issuer after the raise has completed):

Invest $0+ and receive 5% Bonus Shares.

Invest $5,000+ and receive 10% Bonus Shares.

*Investors can only receive one (1) amount-based incentive per investment.

**In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

***Crowdfunding investments made through a self-directed IRA cannot receive non-bonus share perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus share perks because they would be receiving a benefit from their IRA account.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 30, 2025

Minimum Investment Amount:

$250

Target Offering Range:

$10,000-$124,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.