As of September 19, 2025 • 11:11 AM ETIndicators

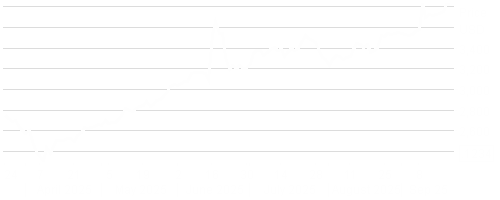

Biggest Gainers

Companies with the largest increase in price when viewed on a percentage change basis.

* Companies that meet the following criteria are included in the indicator:

- Included in the LDMicro Index or have a market cap between $10m-400m

- US / Canadian listed

- $20,000+ worth of stock traded today

| Ticker | Change |

|---|---|

| AGMH | 525.59% |

| TWOH | 41.18% |

| QMCO | 36.92% |

| FTEL.CN | 29.63% |

| MEND:CNX | 28.79% |

| CCM | 25.46% |

| GXU.V | 25.00% |

| FATN | 24.79% |

| CRCW | 23.81% |

| ATMV | 21.98% |

Biggest Losers

Companies with the largest decrease in price when viewed on a percentage change basis.

* Companies that meet the following criteria are included in the indicator:

- Included in the LDMicro Index or have a market cap between $10m-400m

- US / Canadian listed

- $20,000+ worth of stock traded today

| Ticker | Change |

|---|---|

| RVPH | 37.94% |

| ATCH | 22.84% |

| IDRA | 21.57% |

| TAR | 20.00% |

| CHMX | 19.29% |

| SONN | 18.73% |

| FTHM | 16.67% |

| RECO.V | 14.93% |

| DEX.V | 13.64% |

| AUD | 12.52% |

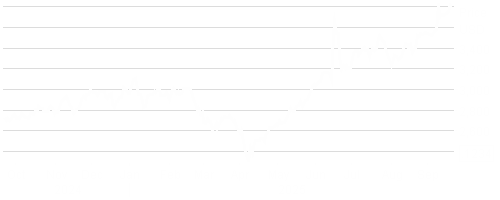

Most Active Volume

Measured as a percentage of the O/S count traded today. Percentage of O/S traded is displayed.

* Companies that meet the following criteria are included in the indicator:

- Included in the LDMicro Index or have a market cap between $10m-400m

- US / Canadian listed

| Ticker | Change |

|---|---|

| AGMH | 7,168.02% / OS |

| BMNR | 596.71% / OS |

| ZOOZ | 259.53% / OS |

| ATCH | 192.75% / OS |

| ADAP | 111.73% / OS |

| VRCA | 74.99% / OS |

| SOWG | 65.92% / OS |

| QMCO | 63.78% / OS |

| NBY | 63.64% / OS |

| CDLX | 50.76% / OS |

Largest Change in Volume

Number of Shares traded today vs 1 month average volume, displayed as a percentage.

* Companies that meet the following criteria are included in the indicator:

- Included in the LDMicro Index or have a market cap between $10m-400m

- US / Canadian listed

- Average value of $20,000+/day traded during last 30 days

| Ticker | Change |

|---|---|

| AGMH | 274x avg |

| FATN | 202x avg |

| VRCA | 141x avg |

| ZOOZ | 61x avg |

| BLIN | 60x avg |

| ZEO | 45x avg |

| SOWG | 44x avg |

| QRC.V | 28x avg |

| ATMV | 26x avg |

| BRFH | 15x avg |

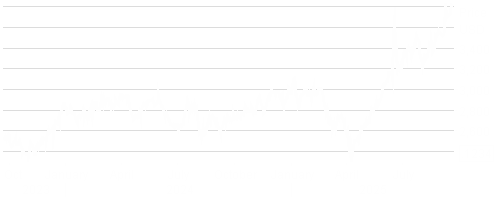

Sector Change %

Average percentage increase/decrease of each sector in the index. No weighting.

| Sector | Change (Avg) |

|---|---|

| Technology | 1.43% |

| Utilities | 0.48% |

| Energy | 0.23% |

| Basic Materials | 0.07% |

| Industrials | 0.02% |

| Media | 0.01% |

| Healthcare | 0.06% |

| Finance | 0.09% |

| Consumer Discretionary | 0.32% |

| Real Estate | 0.35% |

| Top News | |

|---|---|

| 09/19/2025 10:16 AM EDT | Reviva Pharma Announces Pricing of $9 Million Public Offering |

| 09/19/2025 10:13 AM EDT | Aurion Completes Non-Brokered Private Placement with Kinross |

| 09/19/2025 10:09 AM EDT | NeoVolta Celebrates RE+2025 Successes & Recaps Announcements |

| 09/19/2025 9:58 AM EDT | Vaxart Announces Withdrawal of Reverse Stock Split Proposal |

| 09/19/2025 9:49 AM EDT | Xponential Fitness Announces Divestiture of Lindora, One of the Dark Horses |

| 09/18/2025 10:09 AM EDT | Caliber Announces Sale of $15.9 Million Perpetual Convertible Preferred and Activation of ATM Program |

| 09/18/2025 9:50 AM EDT | Burcon Announces New Board Members and Results of Shareholder Meeting |

| 09/18/2025 9:49 AM EDT | Aeluma Announces Proposed Public Offering of Common Stock |

| 09/18/2025 9:46 AM EDT | Sangoma Announces Fourth Quarter and Fiscal Year 2025 Results |

| 09/18/2025 9:44 AM EDT | Nasdaq Halts Apollomics Inc., Ltd. |

Latest Press Releases

| Date/Time | Premium | Member of LD Micro Index | Symbol | Company | News Release As of September 19, 2025 • 11:11 AM ET |

|---|

As of September 19, 2025 • 11:11 AM ETCompany Listings

| Ticker | Premium | LD Micro Index Member | Company Name | Price | Change | Volume | Market Cap | P/E | Div Yield | Exchange | Sector |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Exro Technologies, Inc. | 0.01445* | - | - | 8.28 m* | - | - | TSX | ||||

| NRGV | NRGV | 2.865 | 6.90% | 1,132,216 | 463.72 m | - | - | NYSE | |||

| A.V | Armor Minerals Inc. | 0.3252* | - | - | 24.92 m* | - | - | TSX Venture | Materials | ||

| AAB.TO | Aberdeen International Inc. | 0.02529* | - | 1,001 | 4.04 m* | - | - | TSX | Finance | ||

| AABB | Asia Broadband Inc | 0.021 | 0.77% | 2,884,616 | 95.24 m | - | - | OTCID | Materials | ||

| AABVF | Aberdeen International Inc | 0.02 | 14.89% | 3,000 | 3.45 m | - | - | Pink Sheets Limited | Finance | ||

| AACG | ATA Creativity Global | 2.49 | 0.90% | 13,792 | 79.46 m | - | - | Nasdaq | Consumer Staples | ||

| AACH | AAC Holdings Inc | 0.032 | - | - | 805.05 k | - | - | OTCID | Healthcare | ||

| AACTF | Aurora Solar Technologies Inc | 0.0118 | - | 87 | 2.42 m | - | - | Pink Sheets Limited | Energy | ||

| AADI | null | N/A | - | - | N/A | - | - | Nasdaq | |||

| AAG.V |

|

Aftermath Silver Ltd. | 0.68653* | 5.56% | 195,053 | 211.97 m* | - | - | TSX Venture | Materials | |

| AAIC | Arlington Asset Investment Corp Class A (new) | 4.84 | - | - | 137.08 m | - | - | NYSE | Real Estate | ||

| AAJP.V | AAJ Capital 1 Corp | N/A* | - | - | N/A* | - | - | TSX Venture | Healthcare | ||

| AAMC | Altisource Asset | N/A | - | - | N/A | - | - | NYSE MKT | |||

| AAME | Atlantic American Corporation | 3.41 | 0.58% | 45,378 | 69.55 m | - | 0.58 | Nasdaq | Finance |