DALLAS, TX -- August 17th, 2023 -- Pathfinder Bancorp, Inc. (Nasdaq:PBHC): Stonegate Capital Partners updates coverage on Pathfinder Bancorp, Inc. (Nasdaq:PBHC). The full report can be accessed by clicking on the following link: PBHC Q2 23 Report

Company Summary

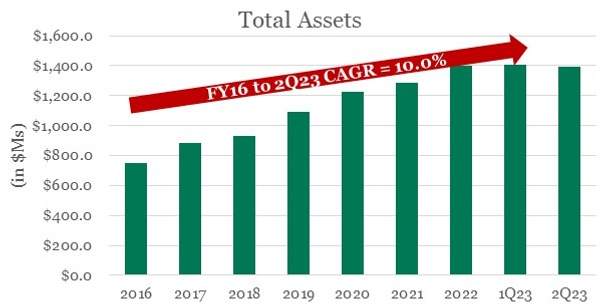

- Pathfinder Bank is focused on measured growth and risk mitigation: Pathfinder Bank is positioned as the market leader in Oswego County, NY by deposit market share and has a growing presence in the attractive Onondaga County, NY market. Given its market position, the Bank has shown consistent balance sheet growth over the past 5 years, with total loan CAGR of 9.6% and total deposit CAGR of 9.5% since 2016. Additionally, the Bank increased allowance for credit losses (ACL) from 1.35% of total loans on June 30, 2022, to 2.28% on June 30, 2023. This is expected to be a shortterm development as management has taken a conservative approach towards risk management given the current macro environment.

- Community banks on strong footing: In the wake of the recent bank failures there has been increased scrutiny in the banking sector. When compared to larger regional banks, we believe that local banks like PBHC are better suited to weather this bank sector turmoil. This is in large part due to community banks in aggregate having less than 10% of their accounts uninsured by the FDIC as compared to SVB’s 95% of accounts being uninsured. It is also notable that banks now have access to the Bank Term Funding Program (“BTFP”), providing increased liquidity and confidence in the banking sector. We note that Pathfinder has never experienced a significant liquidity event. Going forward, however, we anticipate increased liquidity requirements from regulatory authorities.

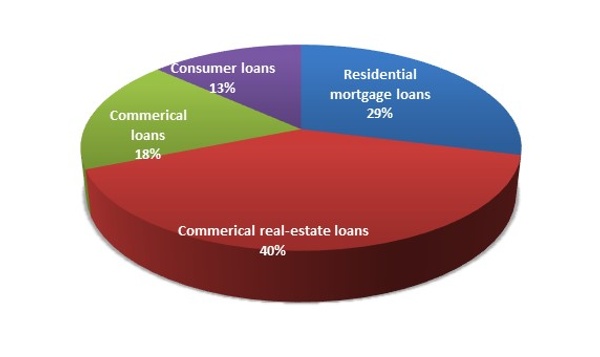

- Well diversified portfolio with good credit quality: Pathfinder Bank’s loan portfolio is well diversified and primarily consists of commercial real-estate loans, commercial loans, and residential mortgage loans. Net charge-offs to average loans were 0.06% in 2Q23 and 0.04% in 4Q22.

- Improving profitability metrics: The Bank has experienced improving metrics over the years with a 14bps increase in ROAA (return on avg. assets) and a 162bps increase in ROAE (return on avg. equity) from 2019 to 2Q23. Notably, the Company has seen decreased metrics year over year, though this is expected to be a short-term effect from the increase in provision for credit losses in 2023 as compared to the first six months of 2022. These metrics are expected to improve sequentially over the balance of 2023.

- Pathfinder Bank is well capitalized: At the end of 2Q23, the Bank’s Tier 1 capital ratio was 9.91%. Additionally, its Total Capital ratio was 15.42% as of June 30, 2023. The Company has historically been proactive in supplementing its ratios for future growth as evidenced by its subordinated debt offerings in FY15 and FY20, and an equity offering in FY19. Lastly, the Company has $22.5M in cash as of 2Q23.

- Valuation: We are using P/TBV and P/E multiples to frame our valuation of Pathfinder Bank. Using a P/TB value range of 1.0x to 1.2x, with a mid-point of 1.1x we arrive at a valuation range of $17.98 to $21.58, with a mid-point of $19.78. When applying a P/E range of 8.5x to 10.5x with a midpoint of 9.5x we arrive at a valuation range of $15.76 to $19.46 with a midpoint of $17.61. Based on the factors laid out on Page 8 of this report we believe PBHC should be trading more in line with comps.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.