Press release

Global P2P Payments Market By Application And Transaction Method: Global Opportunity Analysis And Industry Forecast, 2023-2030

Market Overview:The P2P Payments Market is expected to grow at a significant growth rate, and the analysis period is 2022-2028, considering the base year as 2021.

Peer to Peer (P2P) payments enable users to transfer money from their bank accounts to other individuals' accounts using the Internet or mobile devices as the digital medium. These payments can be categorized as either internal or domestic transfers, based on whether they are made to accounts within or outside of the bank. Internal transfers occur when the payee's account is held by the same bank, while domestic transfers are made to accounts held by other banks. Customers can initiate both types of transfers from a single Transfer Money screen by saving the payee's bank account information. According to a recent survey conducted by Billtrust, 32% of Generation Z individuals use P2P payment systems.

Key Players For The Global P2P Payments Market

•Alibaba.com

•Apple Inc.

•Circle International Financial Limited

•Google LLC

•One97 Communications Limited (Paytm)

•PayPal Holdings Inc.

•Square, Inc.

•WePay Inc.

•Wise Payments Limited

•Zelle

•Venmo, LLC and other major players.

Acquire PDF Sample Report + All Related thorough TOC, Graphs and Tables of Global P2P Payments Market Now:

https://introspectivemarketresearch.com/request/15364

Market Dynamics:

Driver:

The market for mobile payment alternatives is experiencing significant growth, driven by several factors. One key factor is the increasing adoption of smartphones in both developed and developing countries, such as China and India. This widespread smartphone usage has led to greater awareness among consumers about the benefits of mobile and online payments. As high-speed internet connectivity options like 4G and 5G become more accessible, users can now conveniently make payments through their smartphones, contributing to the industry's expansion.

Opportunities:

The high level of competitiveness in the market for peer-to-peer payment methods, along with the significant presence of service providers worldwide, creates opportunities for the introduction of new convenient services. This competitive environment encourages various players to offer a wide range of products and services to cater to the needs of a large user base. The intense competition drives contenders to vie for the top position, often resulting in acquisitions or collaborations with new rivals. Significant investments are made in research and development initiatives, leading to technological advancements, updates, and the introduction of innovative P2P payment capabilities.

Read More This Research Report: -

https://introspectivemarketresearch.com/reports/p2p-payments-market/

The Report Will Include A Major Chapter

•Patent Analysis

•Regulatory Framework

•Technology Roadmap

•BCG Matrix

•Heat Map Analysis

•Price Trend Analysis

•Investment Analysis

•Company Profiling and Competitive Positioning

•Industry Value Chain Analysis

•Market Dynamics and Factors

•Porter's Five Forces Analysis

•Pestle Analysis

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Market Segmentation

By Transaction Method, Near Field Communication segment is expected to dominate the P2P Payments Market. Strong demand in the NFC (near field communication) market will enable customers to better serve themselves by offering them a simple and hassle-free payment solution. Thanks to NFC technology, retailers can now include customer loyalty programs in their payment options, and customers can easily use coupons on their mobile devices. This market's expansion is projected to be aided by the expansion of online business platforms and the continued usage of cutting-edge technology for financial transactions. The adoption of NFC-based installments would probably be accelerated by the rising popularity of wearable installment devices and the emergence of a flexible trading pattern.

By Application, the Retail sector dominates P2P Payments Market. The increasing use of cell phones and the corresponding expansion of portable trade agreements are encouraging the segment's potential future growth. Mobile applications are currently, by far, the most used method of making purchases. Several shopping apps are used for 54% of flexible business payments, according to J.P. Morgan's 2020 E-trade Payments Trends Report. Another important aspect influencing the trend for flexible installments is increased cross-line acceptance. The issue in the fragment is getting worse because certain banks are seeking to forcefully forward portable installments. A modified setup of comprehensive installment solutions is also being developed by organizations to meet specific problems in the executive, lending, and security sectors.

By Transaction Method:

•Near Field Communication

•Mobile Web Payments

•SMS/Direct Carrier Billing

•Others

By Application:

•Media & Entertainment

•Energy & Utilities

•Healthcare

•Retail

•Hospitality & Transportation

Get 50% Discount on This Report:

https://introspectivemarketresearch.com/discount/15364

Regional Analysis Of the P2P Payments Market

Asia Pacific dominates P2P Payments Market and is expected to make substantial advancements during the forecasted period. This is a result of numerous governments encouraging the use of electronic payments. Additionally, developing countries like India are undertaking a wide range of efforts and programs to promote digital payments. The Digital India initiative is one instance of this. Among the market leaders in Asia-Pacific for P2P payments are China and Indonesia. The main factor influencing the potential P2P payments industry in China is the availability of cutting-edge FinTech services there. Due to the absence of alternative investment alternatives and the higher returns provided by P2P investments, China has also been attracting investors. Around 904 million individuals in China utilized mobile payments in 2021. Mobile payments have mostly replaced cash and credit cards as the preferred payment option in the retail sector.

By Region:

•North America (U.S., Canada, Mexico)

•Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

•Western Europe (Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

•Asia-Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

•Middle East & Africa (Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

•South America (Brazil, Argentina, Rest of SA)

Key Industry Development In The P2P Payments Market

In February 2022, the introduction of Tap to Pay on the iPhone was announced by Apple. The new feature will enable millions of merchants in the US, from small businesses to large retailers, to use their iPhones to seamlessly and securely accept other digital wallets, including Apple Pay, contactless credit and debit cards, and Apple Pay, with just a simple tap to their iPhone - no additional hardware or payment terminal is required.

In September 2021, the all-in-one, personalized PayPal app, which provides users with the greatest location to manage their financial lives, was recently unveiled by PayPal. In addition to new in-app shopping options that let users earn points redeemable for cash back or PayPal shopping credit and find bargains with hundreds of shops, the new PayPal app will also feature PayPal Savings, a new high-return savings account offered by Synchrony Bank.

Inquire Before Purchase: -

https://introspectivemarketresearch.com/inquiry/15364

Table of Content:

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Transaction Method

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: P2P Payments Market by Transaction Method

5.1 P2P Payments Market Overview Snapshot and Growth Engine

5.2 P2P Payments Market Overview

5.3 Near Field Communication

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Near Field Communication: Geographic Segmentation

5.4 Mobile Web Payments

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Mobile Web Payments: Geographic Segmentation

5.5 SMS/Direct Carrier Billing

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 SMS/Direct Carrier Billing: Geographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation

Chapter 6: P2P Payments Market by Application

Continued….

For More Related Reports Click Here:

https://introspectivemarketresearch.com/reports/online-grocery-market/

https://introspectivemarketresearch.com/reports/smart-labels-market/

https://introspectivemarketresearch.com/reports/human-combination-vaccines-market/

https://introspectivemarketresearch.com/reports/time-tracking-software-market/

https://introspectivemarketresearch.com/reports/bicycle-tires-market/

Buy the Latest Version of this Report @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15364

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

Email: sales@introspectivemarketresearch.com

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global P2P Payments Market By Application And Transaction Method: Global Opportunity Analysis And Industry Forecast, 2023-2030 here

News-ID: 3088810 • Views: …

More Releases from Introspective Market Research

Vegan Food Market Growing at 9.9% CAGR to Hit $ 37,332.36 Million by 2030 |Growt …

Market Synopsis:

The anticipated growth of the Vegan Food Market is projected to witness a substantial increase, escalating from USD 17,543.00 Million in 2022 to an estimated USD 37,332.36 Million by 2030. This growth is forecasted to occur at a remarkable Compound Annual Growth Rate (CAGR) of 9.9% throughout the forecast period spanning from 2023 to 2030.

Vegan cuisine includes foods that are free from animal-derived products, such as meat, dairy, eggs,…

Automotive Armrest Market By Type, By Material, By Sales Channel, By Region- Glo …

The Global Automotive Armrest Market size is expected to grow from USD 2.01 Billion in 2022 to USD 2.17 Billion by 2030, at a CAGR of 0.98% during the forecast period (2023-2030).

Automotive Armrest are a feature of automobiles that enable drivers to rest their hands or store important items so that they can be easily accessed when driving. Space, a cup holder, and control of certain non-essential vehicle functions are…

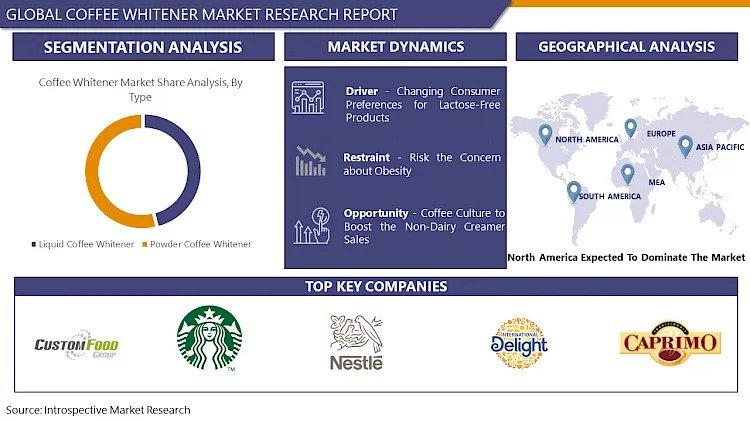

Coffee Whitener Market size to increase by USD 27.98 Bn | Driven by growing prom …

Market Overview:

The global coffee whitener market is estimated to be worth USD 18.1 billion in 2022 and is projected to reach USD 27.98 billion by 2030, growing at a CAGR of 5.6% from 2023 to 2030.

Coffee whitener, available in liquid or granular form, serves as a milk substitute when added to coffee. Termed also as coffee creamer, its popularity is set to surge due to the growing vegan movement,…

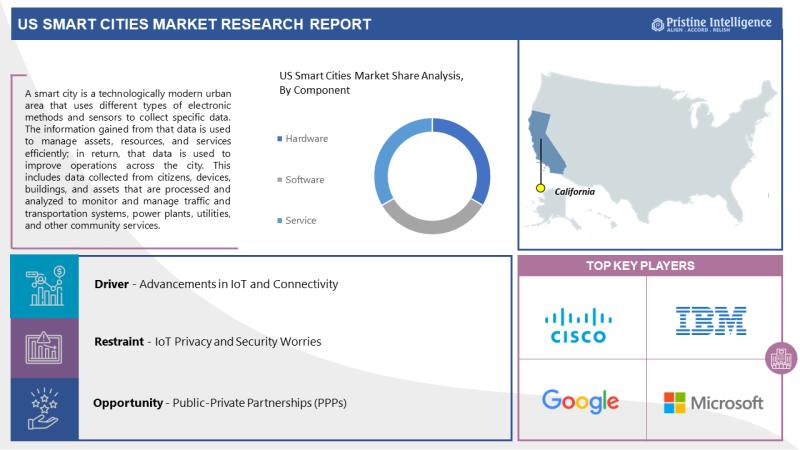

US Smart Cities Industry Development, Key Manufacturers and Forecast Report 2023 …

Market Overview:

The US Smart Cities Market is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The US Smart Cities Market is a dynamic and rapidly evolving landscape focused on transforming urban areas through the integration of innovative technologies and data-driven solutions. Smart cities leverage digital infrastructure, IoT devices, data analytics, and connectivity to enhance the quality of life, sustainability,…

More Releases for Pay

Mobile Payment Services Market 2022-2027: Onset of Advanced Technologies to Upsu …

The most recent research report on the Global Mobile Payment Services Market offers the collective study on the COVID-19 epidemic in order to give the latest data on the key attributes of the Mobile Payment Services market. This intelligence report comprises analysis on the basis of current situations, historical data and future projections. The study comprises several market estimates correlated to market size, revenue, production, CAGR, consumption, gross margin in…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…

Mobile Payment Market may see a big Move: Apple Pay, Samsung Pay, Amazon Pay

A new business intelligence report released by HTF MI with title "Global Mobile Payment Market Report 2020" is designed covering micro level of analysis by manufacturers and key business segments. The Global Mobile Payment Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some…

Electronic Payment Market Growth Insights to 2024 by Leading Players like Alipay …

Electronic Payment is a payment solution which is made through digital modes with no hard cash. In digital payment, both payer and payee use digital modes to send and receive money. Digital payment include payment gateway solutions, payment processing solutions, payment wallet solutions, payment security and fraud management solutions, and POS solutions.

Scope of the Report:

The global Electronic Payment market is valued at xx million USD in 2018 and is expected…

Payment Landscape Market to 2024 By Key Players - Samsung Pay, Google Pay, Apple …

For people who are keen on the Payment Landscape Industry the Global Payment Landscape Market Trends, Competitive Analysis and Forecast Report 2019-2024 would be an useful report to refer to as it is an exhaustive study on the present market scenario of this industry. The report also gives a special insight into the growing United States, Europe, APAC, Middle East and Africa market of this industry. The report summarizes key…

Payments Landscape in Australia Market Expected to Generate High Revenue in Futu …

Global Payments Landscape in Australia market report offers in-depth knowledge and analysis results and knowledge concerning Payments Landscape in Australia market share, growth factors, size, key drivers, restraints, opportunities, and trends valid by a mixture of specialists with correct data of the precise trade and Payments Landscape in Australia market further as region-wise analysis experience. The Payments Landscape in Australia report contains historical, current, and projected revenues for every sector,…