DALLAS, TX -- July 31st, 2023 -- Grounded Lithium Corp. (TSXV: GRD) (OTCQB: GRDAF): Stonegate Capital Partners updates their coverage on Grounded Lithium Corp. The full report can be accessed by clicking on the following link: GRD Q2 2023 Report

COMPANY UPDATES

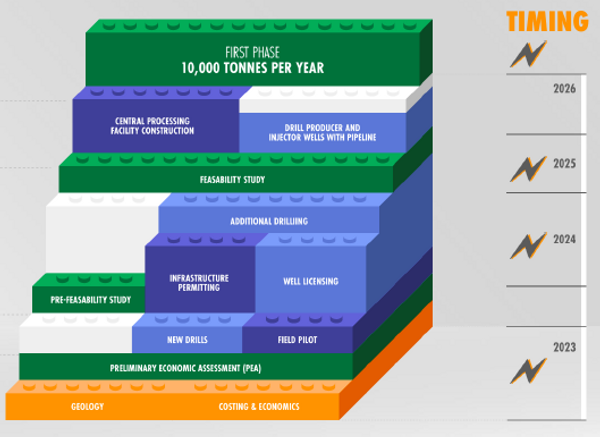

- Significant Progress: Grounded Lithium Corp. has accomplished a number milestones since the start of 2023 that we believe warrant a re-rating of the stock. Year to date GLC has selected a DLE provider in Koch Technology Solutions (“Koch” or “KTS”) and announced the results of its much-anticipated PEA. In 2H23 and into FY24 we also expect the Company to appreciate as the market digests the PEA results, the Company expands its resource base, and a path to commercial production solidifies.

- DLE Selection: Current demand estimates for lithium far exceed current supply options. This is even more acute in North America where Grounded operates. One of the critical components of operating a lithium brine operation is the Direct Lithium Extraction method used. With the selection of Koch, GLC has taken a large step towards serving this demand. This will allow Grounded to get their operations to full economic production on a timescale that will benefit from the supply/demand imbalance. With a 98% lithium extraction recovery rate, the next step is for KTS to deploy a several months long field pilot. The results of this pilot will help inform the overall commerciality of the project.

- Clean balance sheet: It is noticeable that the Company does not have any liens on their property, nor have they engaged in any royalty agreements. Additionally, there is no debt on the balance sheet, putting GLC in a strong position going forward. We also note that the Company has enough working capital to maintain operations through near-term catalyst, in part due to the low cash burn rate. We think that this strong balance sheet along with management’s personal investment into the project shows the alignment between investors and management.

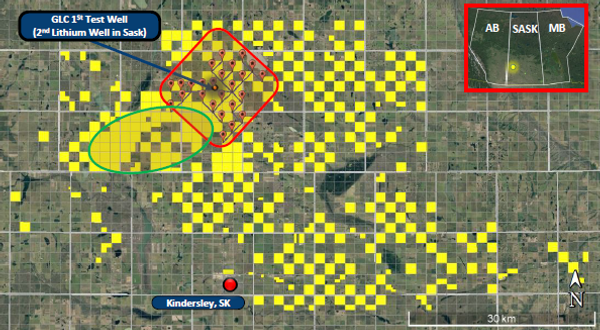

- Impressive PEA Results: The PEA was highlighted by several encouraging results, most notably the after tax NPV of $1.0B and an internal after-tax IRR of 48.5%. These outcomes are based on an LHM price/ton of $25,000, a discount rate of 8%, and capital investment of $335.0M. Most notable of these variables is the LHM price/ton of $25,000, which is significantly lower than current spot rates. When we consider the highest sensitivity provided with an LHM price/ton of $35,000 it returns an after tax NPV of $1.6B. We believe this NPV is closer to our estimate of the current Phase 1 NPV. Given that these results only consider 24 of GRD’s 300 sections of land holdings, we view this as a very positive step towards realizing the KLP’s otential.

- Valuation: We value GRD using an EV/NPV multiple in comparison to peer companies EV/NPV multiples. When we apply our EV/NPV multiple to Phase 1 it results in a valuation range of C$0.55 to C$1.10 with a midpoint of C$0.82. When we adjust this value for the likely expansion beyond Phase 1 it results in a valuation range of C$0.72 to C$1.43 with a midpoint of C$1.08. We believe this increased range is more accurate and is further supported by the Arizona Lithium acquisition in December 2022, which would value GRD at ~C$1.04.

About Stonegate Capital Partners

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.

Stonegate Capital Partners is a Dallas-based corporate advisory firm dedicated to serving the specialized needs of small-cap public companies. Since our inception, our mission has been to find innovative, undervalued public companies for our network of leading institutional investors who seek high-quality investment opportunities.