DALLAS, TX -- June 9th, 2023 -- Los Andes Copper, LTD (TSXV: LA): Stonegate Capital Partners updates their coverage on Los Andes Copper, LTD. The full report can be accessed by clicking on the following link: Los Andes Copper Q2 2023 Report

COMPANY UPDATES

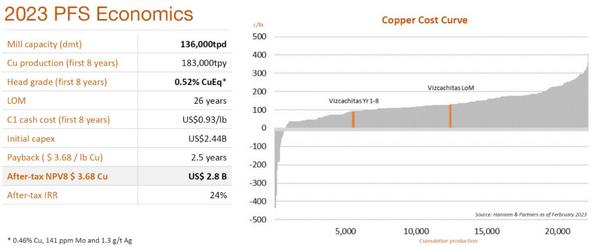

- PFS shows robust economics of project: In February of 2023 Los Andes released its Preliminary Feasibility Study (“PFS”) which held very promising results. Most notably the PFS has given investors greater insight into the strong economics of the project. With a mine life of 26 years, the location allows for operations 365 days per year. The PFS has set the proven and probable reserves at 10.9bn lbs. Copper Equivalent (“CuEq”), increased the amount of measured and indicated resources by 16% to 14.8bn lbs. CuEq, and the amount of inferred resources by 130% to 15.4bn lbs. CuEq. This results in a post-tax NPV of $2.8bn assuming a copper price of $3.68 per pound and a discount rate of 8%. The payback period is estimated at 2.5 years after initial production.

- Project highlights: Los Andes is the full owner of the Vizcachitas copper project, which is one of the largest undeveloped copper projects in South America. The project is situated within Chile’s prolific Central Copper Belt which hosts a number of Tier 1 copper projects. Vizcachitas is strategically located to be sold to a mining major should the Company choose this route. Aiding this optionality is the mentioned 100% ownership of the project making any sales easier to navigate as well as the large size of the project making it enticing to majors.

- Sustainability in focus: Los Andes is committed to operating a sustainable and responsible mine. This is illustrated by the Company reducing both their energy and water usage plans by 25% and 50% respectively. Additionally, Los Andes has entered into a water desalination consortium which will eliminate the need to draw continental water and will give local population an opportunity to access water at preferred rates, an option they would not have otherwise.

- Capital remains accessible: Subsequent to the end of FY2022 the Company completed a $10.0mn bought deal offering. This financing consisted of 800,000 issued common shares at C$12.55 per share. Given the early stage that the Vizcachitas Project is in, we find it very encouraging that Los Andes is able to access large blocks of capital. This capital will be used to support the planned drilling and corporate costs.

- Strong management team and ownership: Los Andes has a track record of having highly capable C Suite executives. This continued in 2022 with the appointment of Santiago Montt, a senior mining executive and lawyer to COO and interim CEO. The Board of Los Andes boasts a robust team that has experience in capital markets, ESG, and the mining industry. It is also notable that The Chairman of The Board represents Turnbrook Mining, the largest shareholder of LA at 51.1%.

- Valuation: The Company is currently trading at an EV/NPV of .11x vs average comps of .33x. Due to the advanced stage of the deposit, significantly larger resource deposit, enticing potential as a takeover candidate from a major, and the positive results from the PFS we believe the company deserves to trade at a premium to comps, applying a multiple range of .35x to .45x with a midpoint of .40x. This results in a valuation range of C$38.86 to C$50.01 with a midpoint of C$44.44. This brings the Company to trade more in-line with the other large projects that have also completed the PFS stage.

About Stonegate

Stonegate Capital Partners is a leading capital markets advisory firm providing investor relations, equity research, and institutional investor outreach services for public companies. Our affiliate, Stonegate Capital Markets (member FINRA) provides a full spectrum of investment banking, equity research and capital raising for public and private companies.